HSN Code List and GST Rate Finder- The labor and products charge is a genuine worth duty that the public authority charges on for all intents and purposes each item and administration sold for family use. All previous federal and state taxes are eliminated by this unified tax system. The GST is paid by those who use the services or buy the goods. However, it is returned to the government by large corporations or small home businesses. With the slogan “One Country, One Tax,” the GST is the result of combining all central taxation (import duties, sales tax, service charges, penalties, and deductions) and state taxation (state VAT/income tax, acquisition tax, luxury tax, amusement tax, immorality tax, etc.). The Harmonized System (HS) code list is a list of unique product codes used by the European Union (EU) to classify and regulate products.

The code list provides a standard method of code representation for species, chemicals, minerals, drugs, and other materials. The list is maintained and regularly updated by the European Commission. The harmonized system of classification is one of the world’s most developed classification systems. It was developed over decades to be consistent from country to country, facilitating trade between EU member states. The system uses a series of three-character codes to categorize product types into groups. The first character represents the type of animal/vegetable; the second character represents the type of substance; and the third character represents the category of use in manufacturing, medicine, or science. For example, Group 1 includes spices,Group 2 includes dairy products, and Group 3 includes metals.

HSN Code List and GST Rate Finder

The Goods and Services Tax (GST) is an indirect tax (also known as a consumption tax) that is levied in India on the supply of goods and services by the Indian government. In India, it is a comprehensive, destination-based, multistage tax. It has practically every one of the circuitous assessments and applied at each phase of the creation interaction so multistage charge. In contrast to previous taxes in India, this tax is collected at the point of consumption, also known as a destination-based tax.

The Goods & Service Tax is levied and collected in five different slabs for goods and services: 0%, 5%, 12%, 18%, and 28%. Electricity, alcoholic beverages, and petroleum products are not included in any slab, so they are exempt from GST. There are a couple of different techniques to gather charge on these great and administrations. The Goods and Services Tax (GST) is a value-added tax charged by each participating government on goods and services consumed within its borders. It is a tax on consumption rather than on production, which allows it to be more efficient than some other forms of taxation. The GST rate can vary from country to country based on local economic conditions and preferences.

HSN Code List and GST Rate Finder Details

| Article for | HSN Code List and GST Rate Finder |

| HSN Code List and GST Rate Finder | Click Here |

| Category | Trending |

| Official website | Click here |

What Is HSN Code?

The full type of HSN means “Orchestrated Arrangement of Terminology”. The World Customs Organization (WCO) developed the HS Code, also known as the HSN Code in India, as a standardized method for categorizing goods globally. HSN Code is a four-, six-, and eight-digit uniform code that is accepted worldwide and categorizes more than 5000 products in India. The first six digits of the HSN Code, which is a universally accepted standard, are the same for every nation. However, additional digits have been added to each country’s HS Code system for the purpose of further classification.

HSN Code is a code used to indicate the shelf price of an item. It is placed on the item’s packaging and is provided by the retailer. HSN codes are useful because they can help consumers compare prices across different retailers. They are also a useful tool for retailers to use in determining product pricing, as it allows them to pass the cost of inventory and overhead onto customers. Keep in mind that HSN codes may change from time to-time, so be sure to check the HSN website for any updates.

Also Read- Chhattisgarh RTO Code List 2023

Why is the HSN code used/required?

HSN Code is a logical method for identifying goods for domestic and international trade because it is an internationally recognized standard for product classification. It can be used in a much more effective manner to gather data and comprehend domestic and foreign trade that takes place within the country as well as outside of it. This will additionally help the public authority in concluding macroeconomic arrangements connected with the exchange of these wares.

Additionally, the HSN code may be required by insurance companies for reimbursement purposes. For example, if you visit a hospital and your insurance company requires you to pay only part of the cost of your care, the HSN code will allow them to know which hospital you visited so they can reimburse you appropriately. All in all, the HSN code helps ensure that patients get appropriate and timely medical care, regardless of their financial situation.

Who provides HSN Code?

The DGFT (Directorate General of Foreign Trade) is in charge of making any modifications to HSN Codes or adding new codes. Product descriptions changes, obsolete codes are removed, new codes are added, etc., are carried out on a regular basis as part of the ongoing effort to perfect HSN Codes.

HSN Code provides several benefits to consumers, including easier navigation of the website and faster checkout. Additionally, HSN Code allows for quicker delivery of products to customers’ homes, since it allows for faster shipping. As HSN Code is a unique identifier for a product or service, it helps ensure that each item purchased from the company is exactly as described.

How Does the Search For HSN Code Work?

- Search for a Product by Name: Simply enter the name of your product and you will receive suggestions for the most appropriate four-digit HSN codes. Hit look for all outcomes in the event that the proposals don’t contain the right HS code. For export-import purposes, details of the 6 and 8-digit HS codes, as well as the GST rates, can be obtained by clicking on the four-digit code.

- Using an HSN Code: Enter the HSN Code’s first two or four digits. Click on the ideal outcome to get more data about the HSN code.

- How can Category List be used to use an HSN code? Under All Categories, we have divided the list of HSN codes into 23 broad categories. Select one of the two-, four-, six-, or eight-digit HSN codes from this menu. Click on a four-digit code to view the GST rates for HSN codes.

Click Also- Free Fire Redeem Code Today 2023

Is HSN Code Mandatory?

The ITC-HS Codes are required for exports. The eight-digit HSN Code must be included on the shipping bill; otherwise, export benefits will not be granted. However, if a dealer is registered under the Composition Scheme of GST or has a turnover of less than Rs 1.5 crore, HSN codes are not required under GST.

HSN Code is not a mandatory requirement for any product you buy from HSN. However, it is a helpful tool that can help you navigate the site and find the products you are looking for. The HSN Code is a unique code that represents a certain product on the HSN website. It contains information about the product’s category, brand, and price. Additionally, it provides useful tips and tricks on how to use or care for the product. If you’re interested in purchasing an item from HSN, it’s best to check out the HSN Code first to make sure the product you want to buy is a good fit for your needs and budget.

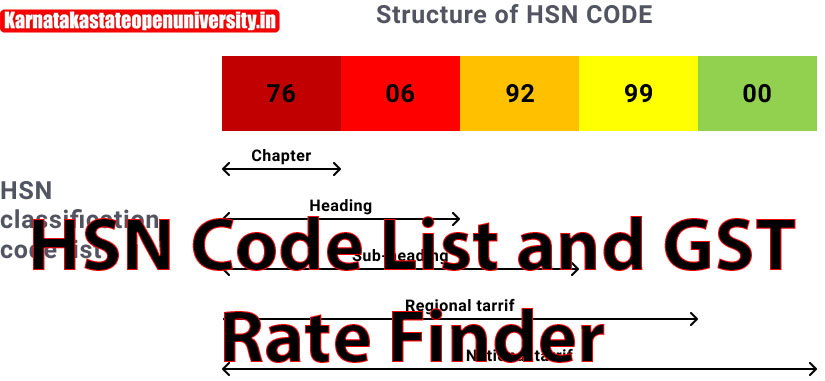

Understanding the Structure & Bifurcation Of HSN Code

In short, each group represents different levels of health and clinical need. So, for example, Group 1 might include patients with minor health concerns that do not require immediate attention, Group 2 might include patients with more serious medical issues that require immediate attention, and Group 3 might include patients with life-threatening conditions requiring urgent medical intervention. Now let’s take a look at how the HSN code is organized. Each group has its own set of criteria that must be met in order to be classified into that group.

So Group 1 might require that the patient have certain symptoms or signs (such as chest pain or shortness of breath), while Group 2 may require additional diagnostic tests (such as an EKG) or hospitalization (for example, for cardiac monitoring). Finally, the HSN code provides a way to classify patients into groups based on their needs so that they can receive appropriate care and treatment. In summary, understanding the structure and bifurcation of the HSN code involves understanding how the HSN code helps classify patients based on their needs, as well as understanding how it is organized into groups with different levels of need.

The Structure of HSN Code

- HSN Codes Divided into 99 Chapters has 21 sections

- each of which describes a specific product category.

Chapters are further subdivided into headings, subheadings, and tariff items in the HSN Code. An HSN Code has eight digits: the Chapter is defined by the first two digits, the headings are defined by four digits, the subheadings are defined by six digits, and the tariff items are defined by eight digits.

Read Also- Doordash Promo Codes 2023

HSN Code and GST

In the past, HSN codes were only applicable to Central Excise and Customs. However, since GST was implemented, businesses are now required to include HSN codes on their tax invoices and report them on their GST returns. In addition, CBIC has reported GST rates based on the classification of goods by HSN. Therefore, the company must first identify the correct HSN Code in order to determine your product’s GST rate. The following were previously the CBIC’s (Central Board of Indirect Taxes) provisions for the HSN Code under GST:

- Yearly Turnover not exactly and up to Rs 1.5 cr – Not expected to make reference to HSN Codes

- Yearly Turnover more than 1.5 cr up to 5 cr – Expected to make reference to HSN Code up to 2 digits

- Yearly Turnover surpassing 5 cr – Expected to make reference to HSN Code up to 4 digits

The preceding notice was updated to require 4/6-digit HSN codes on supply of goods tax invoices, making it effective as of April.

- Aggregate turnover in the previous year up to $5 million – Must mention HSN Code up to 4 digits.

- Aggregate turnover in the previous year greater than $5 million – Must mention HSN Code up to 6 digits

Check Also- Kerala RTO Code List 2023

Example of HSN Code

The HSN system is used to categorize almost all goods in India. Based on their turnover and nature of exchanges, a business needs to decide the 4, 6 or 8 digit code for their item. In light of this, let’s look at an example with three different scenarios: Scenario 1: Mr. A, a domestic trader who sells cement, needs to know the HSN code in order to raise his tax invoices.

- Scenario 2: Mr. A will require the four-digit HSN Code for his product because his turnover is below $5 million. He concludes that the HSN Code 2521 – Cement, including cement clinkers, whether coloured or not, is the most suitable HSN Code for his product after conducting research, and he accordingly mentions it in his GST returns and invoices.

- Scenario 2: Mr. A will be required to report a six-digit HSN code if his turnover exceeds $5 million. In that scenario, he would then determine the correct six-digit HSN Code in accordance with his product’s specifications. If his cement is aluminous, he will choose HSN Code 252330 because it is the most accurate.

- Scenario 3: Mr. A also sells cement to the United States. He must report the correct HSN Code in order to raise his invoices and file his customs paperwork. Mr. A must now provide an eight-digit code for his product because this transaction now involves the export of goods. He prepares his export documents after determining that the eight-digit code for aluminous cement is HSN Code 25233000.

Click Here- 15 Best All Punta Cana All Inclusive Resorts

What Is The Meaning Of 8 Digit HSN Code Or What Is The Structure Of HSN Code?

HSN Codes is made up of 21 sections that are broken up into 99 chapters. Each chapter describes a specific product category. Headings, subheadings, and tariff items further divide the chapters. An HSN Code has eight digits: the Chapter is defined by the first two digits, the headings are defined by four digits, the subheadings are defined by six digits, and the tariff items are defined by eight digits. Under GST, all eight-digit HSN codes must be used for exports and imports. HSN codes will be announced on April 1, 2021.)

The HSN code is a unique way of identifying products sold on the Home Shopping Network. It consists of 8-digits, each representing a specific product category or type. For example, the HSN code for Avon products is ‘06694’. The first two digits represent the brand (such as ‘0’ for Avon), while the remaining 6-digits represent the product category (in this case, ‘6’ for beauty and skin care products). This code system makes it easy for customers to find products they’re looking for and enables HSN to efficiently manage inventory.

Difference between HSN Code and SAC Code

Under GST, the Harmonized System of Nomenclature (HSN) code is used to classify goods. The World Customs Organization (WCO) issued the codes. They are used to group similar-natured goods into different sections, chapters, headings, and subheadings. Under GST, the Services Accounting Code (SAC Code) is used to classify services. The Central Board of Excise and Customs (CBEC) issued the codes. Because each service has its own distinct SAC, they are used to classify all of the services. It streamlines and simplifies the GST return filing process in both scenarios.

HSN stands for Home Shopping Network, and SAC stands for Superstore Acquisition Code. HSN is a type of online shopping platform where customers can browse and purchase products from various brands and retailers. In contrast, SAC is a code used by grocery stores to identify the products they sell.

The main difference between the HSN code and the SAC code is that HSN is a shopping platform while SAC is a code used by grocery stores. HSN supports a wide range of products and brands, making it easier for customers to find exactly what they’re looking for. In contrast, SAC codes are used to identify products sold at grocery stores so that customers can choose the right items for their diets and budgets.

Also Read- Calendar 2023 Events, Holidays, Festivals

What Is The Difference Between ITC-HS Code And HSN Code?

Indian Trade Classification (ITC) is also known as the Indian Tariff Code. India implemented ITC-HS for import-export operations. The eight-digit nomenclature found in the first schedule of ITC HS Codes is separated from the description of goods in the second schedule. The addition of two additional digits by ITC to the six-digit HSN structure to classify “Tariff Items” is the primary distinction between the ITC-HS Code and HSN Code. This addition was carried out in accordance with the guidelines of the HS system established by WCO without modifying the existing structure.

HSN is a code used by the HSN network to identify products. The HSN code consists of 6 digits that are separated by a dash. The first 3 digits identify the product category, while the last 3 digits identify the product itself. For example, if you were looking for a hair product, you would enter HSN 1710-0056 in your search engine. The SAC code is a standard set of numbers and letters used to identify products and services offered by companies in the supply chain. These numbers and letters are usually displayed on packages and labels to help communicate information about a product or service to customers.

What If The HSN Code You Have Used Is Wrong?

If you are an exporter, using the wrong HS Code could cause issues with your shipment during customs inspection. Denial of import privileges, substantial custom duty charges, penalties for noncompliance, and other issues may arise. In GST, the buyer will not be able to claim Mr. Mr.’s input tax credit if you used the wrong HSN Code.

ITC-HS Code stands for Imported Transportation and Contribution-Hospital and Surgical. HSN Code stands for Healthcare Services not including Medical or Surgical. ITC-HS Code is used to represent the cost of transportation, shipment, or other services that are provided by an outside company and are imported into the country. HSN Code is used to represent the cost of healthcare services not including medical or surgical procedures. There is a difference between these codes because one represents the cost of a specific type of service while the other represents a broader category of services.

Conclusion

In conclusion, HSN’s code list and ratefinder is an invaluable tool when looking for the best beauty products at the most affordable prices. So why not give us a try today? You won’t be disappointed. HSN code lists are an excellent resource when looking for the best products at HSN. These lists contain items organized by category and include product descriptions as well as HSN codes and GST/HST rates. Once you’ve found a product that you’re interested in purchasing, simply enter the HSN code at checkout to receive the discounted price.

Related Post-