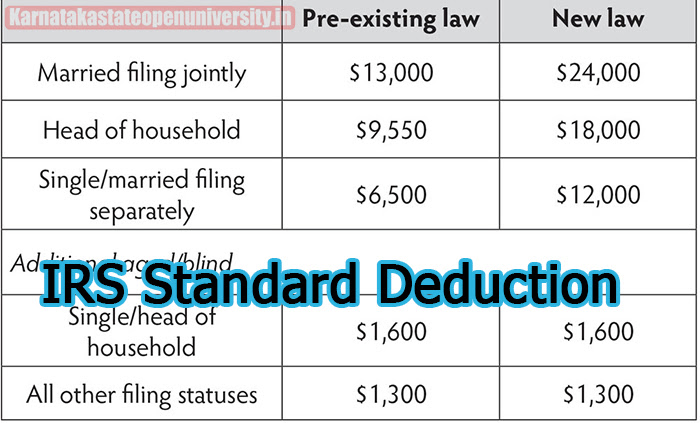

IRS Standard Deduction:- The IRS Standard Deduction is a fundamental provision in the U.S. tax code that make simple the process of calculating taxes for individuals. This subtraction serves as an alternative to itemizing various deductible expenses, making it mainly advantageous for those without significant itemizable deductions or compound financial situations. The IRS Standard Deduction lessen the taxpayer’s gross income, directly impacting the amount of income that is them to taxation. The specific amount of the standard deduction varies found on the individual’s filing status, such as single, married filing jointly, or head of household.

The standard deduction is a fixed amount that taxpayers can subtract from their taxable income, which reduces the amount of tax they owe. The IRS determines the standard deduction each year based on inflation and other factors. By taking the standard deduction, taxpayers can simplify their tax filing process and potentially lower their overall tax liability. However, some individuals may benefit from itemizing deductions if their total itemized deductions exceed the standard deduction amount.

IRS Standard Deduction

It means a lot to take note of that these sums can change every year because of changes for expansion, so people should allude to the most recent IRS rules for precise figures. The Standard Deduction Calculator is an online tool provided by the IRS that assists taxpayers in determining the appropriate amount of a deduction based on their particular circumstances. To provide a customized estimate of the standard deduction, this calculator takes into account variables like age and filing status. The individual’s specific financial situation and objectives for tax planning will determine whether they opt for the IRS Standard Deduction or itemized deductions.

During the tax filing process, taxpayers must make a strategic decision regarding whether or not to claim the IRS Standard Deduction. It’s suggested when the all out amount of admissible organized derivations falls beneath the standard derivation limit for the separate recording status. Not only does this simplified method of calculating taxes save time, but it also simplifies paperwork and record keeping. It’s important for taxpayers to consider their individual circumstances and consult with a tax professional to determine whether taking the standard deduction or itemizing deductions is more advantageous for them.

IRS Standard Deduction Details

| Article Title | IRS Standard Deduction |

| Deduction Name | Standard Deduction |

| Released by | IRS |

| Category | Trending |

| Year | 2023 |

| Official Website | irs.gov.in |

Check Also:- Outer Banks Season 4 Release Date

IRS Standard Deduction for individual

The IRS Standard Deduction for individual is a prearranged amount that reduces an individual’s taxable income, offering a make simple way to calculate taxes. It’s an different to itemizing deductions. The deduction amount varies based on filing status & changes annually to adjust for inflation. The IRS Standard Deduction for single for the 2023 tax year were $12,550 for single filers, $18,800 for heads of household and $25,100 for wedded couples filing jointly. Individuals who qualify as blind or are aged 65 & older may have tall standard deduction amounts.

IRS Standard Deduction Calculator

Taxpayers can use the useful IRS Standard Deduction Calculator to determine the appropriate standard deduction for their particular financial situation. This web-based mini-computer considers factors like documenting status, age, and possible visual deficiency to give a precise gauge of the standard allowance sum that can be guaranteed. People can quickly determine how much of a reduction in their taxable income will occur by entering pertinent information, which has a direct impact on their overall tax liability.

The IRS Standard Derivation Adding machine works on the dynamic interaction by offering understanding into whether it’s more valuable to take the standard allowance or pick organizing allowances. It is an essential resource for taxpayers who want to maximize their tax planning and ensure that they claim the highest possible deduction amount for their circumstances.

Read Also:- Akhil Marar (Bigg Boss Malayalam 5 Winner) Wiki

The standard deduction for dependents

A tax provision known as the standard deduction for dependents allows individuals who are claimed as dependents on the tax return of another person to receive a deduction for their own income. For the most part, wards are people who depend on someone else, frequently a parent or gatekeeper, for monetary help dependents, such as students or young adults, may claim a standard deduction of $1,100 or their earned income multiplied by $350, whichever is greater.

This provision acknowledges that dependents typically have fewer financial responsibilities and lower incomes. It makes it easier for them to manage their financial obligations and meet other needs because it gives them a way to lower their taxable income.

When to claim the standard deduction?

Taxpayers with straightforward financial circumstances and few itemizable deductions should consider taking the standard deduction. When a person’s total allowable itemized deductions, such as mortgage interest, medical expenses, and charitable contributions, fall below the standard deduction threshold for their filing status, this is a good idea.

It is more efficient to claim the standard deduction if a person’s expenses do not exceed that amount because it simplifies tax calculations and paperwork. The standard deduction should also be chosen by taxpayers who either prefer to file their taxes in a less time-consuming manner or lack significant records of itemizable deductions. Nonetheless, in the event that a person’s organized derivations surpass the standard allowance, it’s by and large more beneficial to organize and diminish their available pay further. During tax planning, the taxpayer’s unique financial circumstances should be carefully taken into consideration when making the decision.

Can Check:- Rapido Referral Code

Impact of IRS Standard Deduction

Below is given the collision of IRS Standard Deduction..

- Simplified Tax Calculations- The IRS Standard Deduction offers a make simple approach to calculating taxes by providing a fastened reduction in taxable income.

- Choice between Standard Deduction and Itemizing- Taxpayers can choose between taking the quality deduction or itemize their deductions based on what’s more financially advantageous.

- Reduction in Taxable Income- The standard deduction directly lessen the taxpayer’s gross income, which in turn lowers the overall amount of income subject to taxation.

- Variation by Filing Status- The standard deduction amount varies depending on the individual’s filing status, such as single, wedded filing jointly, or head of household.

- Inflation Adjustments- The quality deduction figures are adjusted annually to account for expansion, potentially affecting the deduction’s impact on tax liability.

- Beneficial for Simpler Finances- Individuals with minimal itemizable subtraction, such as mortgage interest or medical expenses, often discover the standard deduction to be more advantageous.

- Key Consideration in Tax Planning- Choosing between the quality deduction and itemizing requires careful assessment of individual monetary circumstances to minimize tax liability effectively.

Conclusion

The IRS standard deduction is a valuable tool for taxpayers looking to simplify their tax filing process and potentially reduce their overall tax liability. By taking the standard deduction, individuals and families can easily claim a set amount of income that is not subject to federal income tax. This eliminates the need to itemize deductions, which can be time-consuming and require extensive record-keeping.

Additionally, the standard deduction is adjusted annually for inflation, ensuring that it remains a relevant and beneficial option for taxpayers. While some taxpayers may still choose to itemize deductions if they have significant qualifying expenses, the standard deduction provides a straightforward and hassle-free way to save on taxes. In conclusion, the IRS standard deduction is an important consideration for all taxpayers and can provide significant benefits when utilized effectively.

FAQ About IRS Standard Deduction

Who can claim the IRS Standard Deduction Calculator?

Any taxpayer can claim the standard deduction. It’s particularly useful for those with limited itemized deductions or straightforward financial situations.

When should I take the standard deduction?

If your standard deduction is greater than the sum of the itemized deductions for which you qualify, then you just take the standard deduction instead. The size of your standard deduction depends on a few factors: your age, your income and your filing status

What is the IRS Standard Deduction?

The IRS Standard Deduction is a fixed amount that reduces your taxable income, resulting in a lower tax liability. It’s an alternative to itemizing deductions and is determined by your filing status.

Related Post:-