Pay house tax online:- The only source of government from the local public is known as tax. Tax is Commonwealth for the Public property. It shows our common interest that we want to use but not to invest in it like roads and others. In the government taxes one of the biggest and biggest sources of tax collection is property tax. In this post we are going to tell you about how to have to pay house tax online, what will be the process to pay the tax online, what are the alternate methods of payment through Paytm and other sources. To know all about Pay house tax online stay with us in this post at last.

Paying house tax online is a convenient and efficient way to fulfill your tax obligations. With the click of a button, you can easily access the online portal and complete your payment from the comfort of your own home. Gone are the days of waiting in long lines or mailing in checks. Online payment options provide a secure and seamless experience, allowing you to make your payment quickly and easily. Not only does this save you time and effort, but it also helps streamline the overall tax payment process for both individuals and government authorities. So why wait? Take advantage of the convenience and simplicity of paying house tax online today.

Pay house tax online

Charge is the principal wellspring of or essential wellspring of government. The equivalent is for the situation with the local charge which is gathered by the public authority and through the nearby district body. Each land owner or legitimate substance needs to pay the duties for the substantial properties including their private home structures and different properties which they host leased to third gatherings. All property owners who acquire properties are required to pay property tax.

The owner has the option of paying the tax once per year or twice per year. Additionally, if you want to pay your taxes, you can do so offline or online using the options provided by the government. Anyway it just relies upon you how you need to pay the duties through the on the web or disconnected mode yet you need to settle the expense. Property owners can now also pay their taxes using the payment app’s application mode.

Pay house tax online Details

| Article Name | Pay house tax online |

| Year | 2024 |

| Category | News |

| Mode | Online |

| Application | Paytm etc |

| Official Website | Click Here |

Check Also:- Karnataka Assembly Election Date

Pay house tax online Delhi

This is the specific technique that you need to follow to pay house charge online Delhi. However, according to area, the specific steps differ from location to location or municipality to municipality. Anyway the means associated with the paying duty will be like the strategy that is given in the abovementioned. We have additionally given the substitute strategy to pay the assessments that you need to follow if the at any point cycle is preposterous in your telephone and whenever it might suit you.

Pay Property tax online

This procedure must be followed if you want to pay the property tax online. You only need to pay the property tax after checking your information at your convenience in the official folder or on the Paytm app. In the wake of paying the local charge the update will be accessible for you of the property ID. However, the property tax can’t be paid online in some places. You can pay your local charge in two ways: the municipality’s official website or a payment platform like Paytm.

Read Also:- Luna 25 Moon Mission Live

How to Check Pay house tax online?

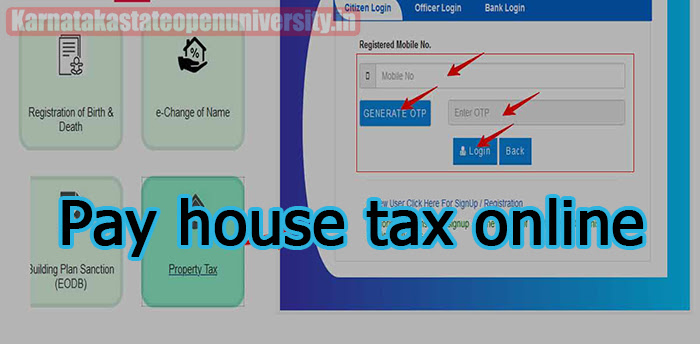

The greater part of the metropolitan bodies need to pay the local charge through their particular strategy whether they need to Play online mode or in their gateway. However, there are some exceptions, such as states that may not permit online property tax payments; however, if a municipality in Texas permits property tax payments, we have provided instructions for doing so. To pay your house tax online, you must follow this straightforward, step-by-step procedure, which can be found below.

- First of all you have to visit the official site of the local municipality.

- Login with your credentials, or if you are not registered then fill the qualification to sign up.

- Click on the tab property tax that is given on the tab

- Now you have to select your property type and assessment year.

- Without all the details that are required along with the property and property name

- Download the copy of the reference slip.

Can Check:- Hyundai Verna Review

Alternate Method Pay house tax online

Presently we have additionally given Sound the other technique that you need to follow to pay the expenses in the web-based mode. Through the Paytm app, there are also some simple procedures.

- First of all you have to visit the Paytm mobile app.

- Now you have to click on recharge and pay bills.

- You are the choice for more service.

- Now you have to click on the municipality tax.

- Without the other particular that are required labour like mobile number and property number.

- Click on get tax amount.

- After paying the amount just take a reference of payslip for your further reference.

Conclusion

Homeowners no longer need to physically visit a location or send payments by mail. Instead, they can conveniently make payments by logging onto a website or using a mobile app. This method not only saves time and effort but also ensures security and efficiency. Online platforms offer various payment options, such as debit or credit cards, net banking, or digital wallets, allowing homeowners to choose the most convenient method for them. Additionally, online systems instantly provide confirmation and receipts to ensure accurate recording of payments. By paying house tax online, homeowners can effortlessly fulfill their obligations and support the efficient operation of their local government.

FAQ About Pay house tax online

How to pay house tax in Delhi online?

Existing Taxpayer can pay tax by clicking on Pay Tax under ACTIONS button. Unique Property Identification Code (UPIC), a 15 digit alphanumeric code is mandatory to pay tax for every property. In case your property don't have UPIC, kindly Apply For New UPICfor payment of property tax.

How to Pay house tax online?

We have given the process to pay the house tax in online mode.

In which portal do I have to Pay house tax online?

There are multiple portals according to the locality of your municipality where you have to pay the taxes.

Related Post:-