Jet Privilege HDFC Bank Diners Club Card- One of the bank’s premium credit cards is the JetPrivilege HDFC Bank Diners Club Credit Card. The Visa accompanies a wide assortment of offers and advantages alongside the arrangement of InterMiles which is a substitute of JPMiles. The card has a monthly interest rate of 1.99% and an annual fee of Rs. 5,000.

The JetPrivilege HDFC Diners Club Credit Card, one of the best travel credit cards available, comes with a lot of air miles that can be used to book flights. In addition, it provides access to complimentary golf instruction, complimentary access to airport lounges, and travel discounts. If you want to choose a credit card, you want to know everything about it, including eligibility, fees and charges, and other important information. Everything is laid out for you to see on this page.

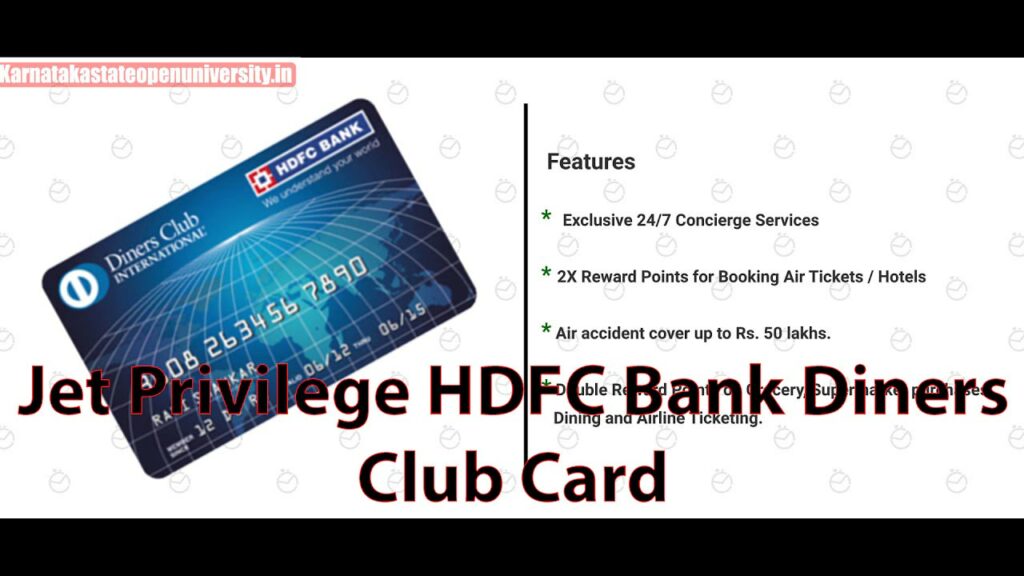

Jet Privilege HDFC Bank Diners Club Card

Your credit history will benefit greatly from timely payment. As a result, you can pay right away with the ease of internet banking. You now have the option of directly logging into HDFC net banking or using the payment gateway website to pay for HDFC credit cards. You can also pay using the NEFT/RTGS/IMPS channel by logging into the online banking of another bank account. Can pay the bill at the bank branch by depositing cash, a demand draft, or a check if you find the online payment process uncomfortable.

The HDFC Bank Diners Club Card is a credit card issued by the bank that allows its users to make purchases, pay bills, and manage their finances using various methods. It comes with various benefits, such as extended warranty, travel insurance, and purchase protection. In addition to this, the card also offers rewards points which can be redeemed for cash or used towards future purchases. Overall, the HDFC Bank Diners Club Card is a great way to manage your finances and give yourself added convenience.

Universal Sompo Health Plan Details

| Article for | Universal Sompo Health Plan |

| Universal Sompo Health Plan | Click Here |

| Category | Trending |

| Official website | Click here |

Key Highlights of JetPrivilege HDFC Bank Diners Club Credit Card

The JetPrivilege HDFC Bank Diners Club credit card is a great option for those who want a high-end card with a generous sign-up bonus and valuable benefits. The card offers both personal and business users a range of exclusive features, such as travel insurance, airport lounge access, and purchase protection. In addition to its generous rewards program, the card also has low intro rates and no annual fees. You can expect to pay less for your everyday expenses with the HDFC Bank Diners Club credit card. Apply now for this top-notch credit card.

- a travel credit card with both co-branding and lifestyle benefits.

- gives you bonus InterMiles to help you get on board.

- Unlimited access to airport lounges and accelerated rewards for travel expenditures

Also Read- How to Check Standard Chartered Bank Credit Card

Features and Benefits for JetPrivilege HDFC Bank Diners Club Credit Card

The card also has an outstanding array of benefits, including Diners Club Gold Rewards points that can be redeemed for free airline tickets, hotel stays, and more. You can also use your Diners Club points to pay for expenses at any Diners Club International restaurant – just make sure you book your reservations well in advance! All in all, the JetPrivilege HDFC Bank Diners Club Card is a great option for people who want to earn miles on their everyday purchases. Check out our website today to learn more about this card and how you can apply online.

Welcome benefits

- When purchasing tickets for a return flight from intermiles.com, receive a Rs. 1,000 discount voucher.

- Up to 30,000 reward InterMiles, which can be reclaimed for flight appointments. Within the first 90 days of card setup, you will receive 15,000 InterMiles for the first swipe, and another 15,000 InterMiles for spending Rs. 1.5 lakh or more.

Renewal benefits

- When you first swipe your credit card within the first 90 days of renewing it, you can earn 10,000 InterMiles.

- When you book a return ticket through the InterMiles website, you also get a discount voucher worth Rs. 750 and a waiver of the base fare.

Reward points program

InterMiles instead of reward points are earned by all JetPrivilege Diners Club Credit Card users.

- You can earn 8 InterMiles for every Rs. 150 spent on retail transactions.

- For every Rs. 150 spent on flight reservations made through the InterMiles website, receive 16 InterMiles.

Click Here- HDFC Credit Card Balance Check 2023

Annual fee waiver

- Spend Rs.8 lakh in a year and get your renewal fee waived for the same year. Only retail spends are eligible for the waiver.

Lifestyle benefits

- Privileges in golf: In India and other countries, select golf courses offer complimentary unlimited rounds of golf.

- Concierge Services are available around the clock to handle your reservations and bookings.

- Flower and gift delivery, restaurant reservations, golf course reservations, limousine reservations, hotel reservations, business reservations, and courier services are all available.

Airport lounge access

- Enjoy complimentary access to over 600 airport lounges worldwide, including those in India. There are conference rooms, Wi-Fi, phones, and fax machines in the lounges.

Benefits from Etihad Airways

- On the InterMiles website, all economy class tickets purchased with your card receive a 5% discount.

- When you buy tickets for Etihad Airways through InterMiles, you can get 2.5x InterMiles.

Dining discounts

- You can get up to 15% discount on food and beverage bills at select fine dining restaurants in various cities of the country.

Fuel surcharge waiver

- The fuel surcharge is refunded for credit card-paid fuel transactions. Transactions between Rs.400 and Rs.5,000 are eligible for a maximum refund of Rs.250 per cycle.

Click Here- Axis Bank Credit Card Payment 2023

Fees and Charges

The table below describes the fees and charges applicable to JetPrivilege HDFC Bank Diners Club Credit Card:

| Type of Fee/charge | Amount |

| Joining fee | Rs.10,000 |

| Annual fee | Rs.5,000 |

| Interest rate | 1.99% per month |

| Cash withdrawal fee | 2.5% of the withdrawn amount (Minimum Rs.500) |

| Rewards redemption fee | Waived off |

| Late payment charges |

|

| Outstation cheque processing charge | Cheque value of up to Rs.5,000 – Rs.25 Cheque value of more than Rs.5,000 – Rs.50 |

| Cash processing fee | Rs.100 |

| Over limit charges | 2.5% of the over-limit amount (minimum Rs.500) |

| Reissue of lost, stolen or damaged card | Rs.100 |

| Foreign currency transaction fee | 3.5% |

| Payment return charges | 2% of payment amount (minimum Rs.450) |

Read Also-ICICI Credit Card Payment Pay ICICI Bank Credit Card

Eligibility Criteria for JetPrivilege HDFC Bank Diners Club Credit Card

Eligibility Criteria for JetPrivilege HDFC Bank Diners Club Credit Card – This credit card is perfect for those who love to travel and want to have the flexibility to pay for their expenses in a variety of ways. The card comes with a variety of benefits, including the ability to earn Diners Club miles on all purchases, as well as a 0% introductory APR for the first year. However, there are a few requirements that you must meet in order to be eligible for this card.

First, you must be at least 18 years old and have a valid government-issued ID. Second, you must have a bank account with HDFC Bank or its subsidiary, Diners Club International (DCI). Third, you must have either an existing Diners Club account or an active card in your name with DCI. To avail the JetPrivilege HDFC Bank Diners Club Credit Card, the following criteria need to be met:

For salaried persons:

- Minimum Age – 21 years

- Maximum Age – 60 years

For Self-employed persons:

- Minimum Age: 21 years

- Maximum Age: 65 years

Documents Required for JetPrivilege HDFC Bank Diners Club Credit Card

To apply for a Diners Club credit card, you must provide proof of income or an existing bank account in India. Applicants must also be at least 18 years old. You may need to provide your original bank statement or pay stub/income statement from your employer. The minimum age for Diners Club credit cards is 19 years old. You must also have a valid address in India or abroad to apply for any of these cards. For more details on application requirements, visit the website listed in the documents required section below.

Keep the following documents ready when applying for the credit card:

- Duplicate of Container card or Structure 60

- Most recent payslip, duplicate of Personal Assessment form or Structure 16

- Verification of home: Passport, driving license, ration card, electric bill, or phone bill from a landline phone

Check Also- Indusind Credit Card Payment Online Login 2023

How to Apply for JetPrivilege HDFC Bank Diners Club Credit Card Online?

Apply online for the HDFC Bank Diners Club credit card at jet.com and enjoy a slew of benefits, including no annual fees, no foreign transaction fees, and no balance transfer fee. Plus, earn bonus points on every purchase, like with most credit cards. The Diners Club Credit Card from HDFC Bank offers exceptional dining rewards: Get 10% back at restaurants and 6X bonus points on airfare, hotels, and other purchases. There are no blackout dates or limits on how much you can spend each month – just make sure to pay your bill on time every month to avoid late fees and penalties. You’ll also have access to 24/7 assistance via phone or online chat and enjoy JetPrivilege benefits like priority boarding and baggage handling.

By going to the HDFC Bank website directly, you can submit an application for the JetPrivilege HDFC Bank Diners Club Credit Card.

Alternately, you can apply for our exclusive partner benefits through .

- How to apply for the card on: To determine your eligibility for the card, click the “Check Eligibility” button on the page.

- The “Apply Now” button will appear once you are found to be eligible.

- Fill in the required information by clicking on it, then select “Submit.”

- You will then be incited to transfer the necessary records.

- Select “Submit” and upload the same.

Related Post-