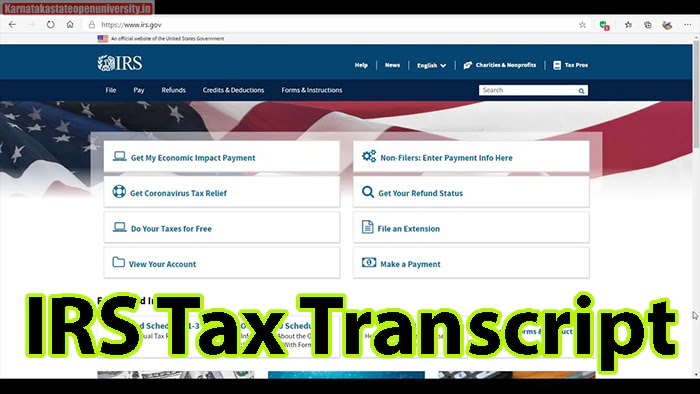

IRS Tax Transcript- Inside income administrations have given the office for charge records. Whether you have a straightforward or more complex tax return, it is essential to ensure that it is thorough. The IRS Tax Transcript, a set of free online tools, can help simplify the process. This post we will inform you regarding how you can check the free internet based devices readily available, what are the advantages of these apparatuses. To have a ton of experience with IRS Expense Record stay with us here finally.

The IRS offers several different types of transcripts, including the most common ones like the Wage and Income Transcript and the Return Transcript. These transcripts can be helpful when applying for loans, mortgages, or financial aid, as they provide proof of your income and tax filing status. It’s important to note that tax transcripts are not the same as a copy of your actual tax return. They provide a summary of the information on your return but do not include any attachments or schedules. To obtain an IRS tax transcript, you can request one online, by mail, or over the phone.

IRS Tax Transcript

Interior income administrations have offered The web-based device in the wake of documenting a total exact return is obviously superior to recording the get back rapidly. So if you have any desire to likewise profit the advantages of this instrument then you can remain with us. Assuming you get away from one of these structures on your profits, it could be a trigger on IRS notice that can postpone the interaction as per the authorities.

Additionally, they stated that you can anticipate receiving your refund within 21 days of submitting your online tax return. According to internal revenue services, this electronic method is a very suitable and error-free return with direct deposit. To utilize the IRS transcript, you must follow this very straightforward procedure. An IRS tax transcript is a document that provides a summary of your tax return information. It includes information such as your adjusted gross income, taxable income, and any credits or deductions claimed on your return.

IRS Tax Transcript Overview 2023

| Title | IRS Tax Transcript |

| Year | 2023 |

| Category | Trending |

| Full Form | Internal Revenue Services |

| Types | Given |

| Website | @irs.gov |

Types Of IRS Tax Transcripts

There are some Part of IRS Tax Transcript–

- Return transcript –most details from your unique government form.

- Account transcript- This is the kind of transcript that you can use when your IRS makes changes after your initial filing, such as an estimated tax payment or an amended return.

- Record of account transcript-consolidated subtleties from return and records record including every one of the wages.

- Wage and income transcript- this is the last record that annual tax documents answered to IRS.

Also Read- Suraj Nambiar Wiki

IRS Transcript

In the kind of IRS record the wages and pay record can be valuable in the event that You Are missing pounds from dependence work or your speculation account. The downside, according to the officials’ explanation, is that the wage and income transcript may not be completed until July. It might in any case be helpful for revision or passing your filings. IRS Record not certain which structures you want auditing last year’s return record might be great for beginning stage.

Check Also- Priyanka Chopra Wiki

IRS Tax Transcript Highlights

As we have previously informed that there are different advantages of an IRS record. Additionally, you can use this for your subsequent loan or other application by taking receipt of it. Whether you are recording a basic or muddled expense form it is basic to ensure it’s precise and complete as indicated by the master. This concludes the discussion of IRS Tax Transcript. If you enjoyed this post, please share it with others.

Read Also- Rohit Shetty Wiki Biography

Other Uses Of IRS Tax Transcript

There are likewise a portion of different clients for IRS record. According to officials, the return transcript may also be useful outside of Tech spelling season. They also said that this will be very helpful, especially when working with businesses or organizations that need to verify your income. For instance on the off chance that you might require your assessment form while applying for the home loan or in a private venture credit or social help. Then, at that point, the test record will be especially useful for you.

Also Check- Bigg Boss Telugu 6 Voting

How To Use IRS Transcripts?

If you want to use the transcript tool as well, one way to check which forms you need is to pull an online IRS transcript, which summarizes some of your most important tax information. You can find out about every record type. We have given the different kinds of record that you can find in the beneath segment. The various kinds of written transcripts, including account transcripts, record of account transcripts, and account transcripts. If you are missing forms from your investment account or freelance work, the various forms of wages and income transcripts can be helpful.

According to the officials, the transcript from the previous year may be a good place to start if you are unsure of the required forms for relieving the previous year. We have provided the IRS Tax Transcript Online procedure, which can be seen in the steps below:

- You should enroll or login to your IRS online record.

- Subsequent to marking in, click get record online choice.

- Pick an explanation starting from the drop menu.

- Select your IRS record by here and download it in the PDF design.

- Therefore, this is the online access method for IRS transcripts.

Conclusion

An IRS tax transcript is a document that provides a summary of your tax return information. It includes details such as your adjusted gross income, taxable income, and any credits or deductions you may have claimed. Tax transcripts are often requested by lenders, employers, and government agencies to verify your income and tax filing status. They can be obtained from the IRS website or by mail, and they are typically free of charge. Having an IRS tax transcript on hand can help streamline various financial processes and ensure accurate reporting of your tax information.

Related Post-