What is Chit Fund 2024 – Money management is an essential aspect of life. Many people wish to invest their money. Many people in India do not yet participate in the organized financial sector. Because they are not eligible for a bank account or do not have the necessary documentation, a lot of people in the lower income bracket choose to invest in chit funds. Investments in chit funds are not always undesirable. Because it has been used to defraud naive investors in the past, it has a bad reputation. Chit funds that are registered and run by the government are safe places to invest. Recurring deposits, on the other hand, are a much safer investment. At the end of the tenure, the returns are fixed and guaranteed. However, the two ventures have their upsides and downsides. Let’s look at how the two choices differ from one another.

Chit fund is a financial investment platform in which small deposits are used to generate high returns on the promise that these investments will increase in value. These types of investments are often referred to as “mutual funds” because they pool capital from multiple investors and use it to invest in different types of securities, such as stocks, bonds, or commodities. Chit funds typically charge a management fee or a commission for the services provided by the underlying fund managers. These fees generally range from 0.5% to 5% of the total value of the fund. However, chit funds can also offer high returns due to the potential for gains in the underlying securities due to market movements or other factors.

What is Chit Fund 2024

A financial instrument that combines borrowings and savings is called a chit fund. For more than a century, it has been a part of India’s financial system. The most fundamental aspect of a chit fund is that a group of subscribers agrees to make a predetermined monthly contribution to a corpus for a predetermined amount of time. After deducting the organizer’s commission, this amount is auctioned to the lowest bidder, and the remainder is divided equally among the remaining members as a dividend.

At the time of the auction, the member with the highest bid wins the amount known as prize money. Therefore, the winner will receive a prize of INR 75,000 if the maximum discount is INR 25,000. After deducting the organizer’s fee, which is typically 5% of the chit value, or INR 5,000, the discount amount of INR 20,000 is divided equally among all 20 members. The chit fund serves as a borrowing scheme for the winner, while the remaining members receive returns on their invested funds (in this case, INR 1,000).

What is Chit Fund 2024 Overview

| Name Of Article | What is Chit Fund 2024 |

| Chit Fund | Click Here |

| Category | Trending |

| Official Website | Click Also |

What is the meaning of Chit Fund?

Chit simply translates to “transaction.” It is also known as chit fund, chitty, kuree, and other names. Chit funds work by requiring a person to enter into a contract with a predetermined number of others under which all of them agree to contribute a certain amount of money or a gain. When the time comes for the individual to claim it, either by himself, through a lot mechanism, or through some kind of auction, he gets the money he needs. He has to pay back the money he got by making regular payments over time.

Chit fund schemes have been run by registered financial institutions or by relatives or friends in some unorganized schemes over the years. Kerala is the state that received the most of these chit funds. Chit funds’ primary function is to facilitate credit access. The popularity of Chit Funds has been on the rise in recent years, with many individuals turning to these investments as a way to generate additional income or diversify their portfolios. However, caution should be exercised when investing in Chit Funds, as there is a possibility that you could lose all your funds. Also, note that Chit Funds are not FDIC-insured, so you are responsible for any losses that occur.

Read Here- What Is The Role Of A Software Development Engineer

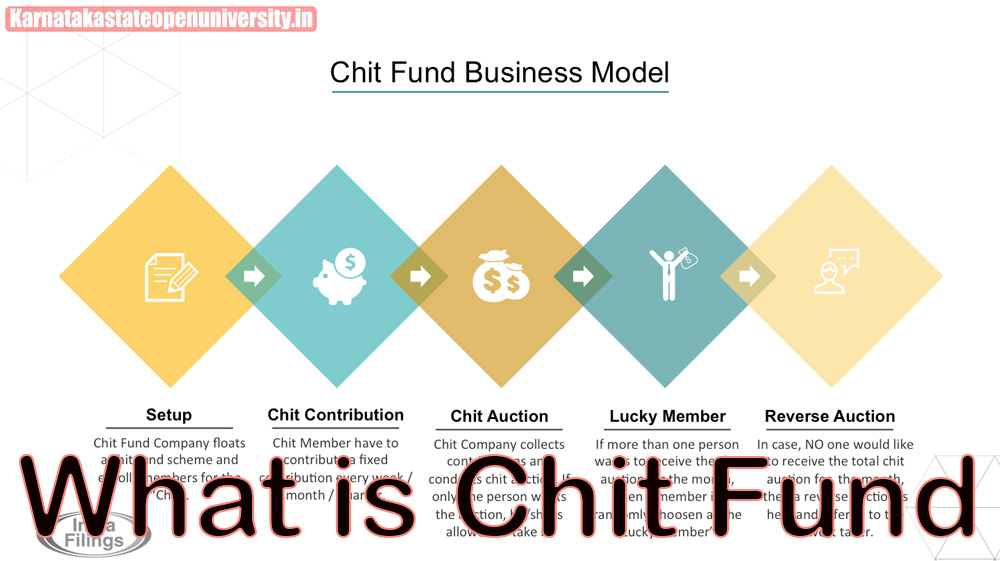

How Chit Funds Work?

We’ll look at an example for chit funds. Let’s say a chit fund is established by a group of ten people. For a period of ten months, each one of them will pay Rs. of months equals no of the fund’s members). There will be a single organizer in this group who will handle all of the meetings, auctions, and other events. He will charge some organizers.

Now, for the first month, each of the ten people gets together and gives Rs. 1000 each. There is currently a total of Rs. 10,000 available. Let’s say three bidders compete for this sum. The bid by Person A is Rs. 9000, and Person B offers Rs. 7000, while Person C offers Rs. 8000. Person B wins the sum of Rs. 7000 because their bid was the lowest. Additionally, he will be charged an organizer fee of approximately Rs. 5 percent. 500. He receives Rs back in full. 6500. The profit, or the remaining 3,000, will be divided equally among all ten people. Each individual receives Rs. 300. A new bidder submits one each month, and the process continues for ten months.

Read Also- What Is Product Management 2024?

What are the Different Types of Chit Funds?

Chit funds are a type of financial scheme in which individuals or companies contribute money to a mutual fund with the expectation of receiving returns based on the performance of that fund’s investments. There are several different types of chit funds, each with its own unique features and benefits. Some of the most common types of chit funds include variable-expense chit funds and fixed-expense chit funds. Variable-expense chit funds charge different fees for different levels of investment risk, while fixed-expense chit funds charge a set fee regardless of how much you invest.

Additionally, there are annuity chit funds, which provide regular payments based on an individual’s age or the performance of the fund, as well as unit-liability chit funds, which allow individuals to withdraw their contributions at any time without incurring any losses. Chit funds can be an excellent way to diversify your investment portfolio and make regular income while reducing your risk.

There are five different kinds of chit funds. Before making a decision about an investment, you need to be familiar with each one.

Special Purpose Chit Funds

These assets work for a particular reason. For example, a few men can frame a gathering to begin an investment funds conspire for Christmas cakes. The end date of such an asset will for the most part be multi week before Christmas. The gathering will utilize the gathered sum to make cakes in mass. From that point forward, cakes will be conveyed to the individuals at Christmas. Thus, specific reason chit reserves limit the endeavors and costs.

Click Also- PM Modi Memories with Mother

Organised Chit Funds

These assets work for a particular reason. For example, a few men can frame a gathering to begin an investment funds conspire for Christmas cakes. The end date of such an asset will for the most part be multi week before Christmas. The gathering will utilize the gathered sum to make cakes in mass. From that point forward, cakes will be conveyed to the individuals at Christmas. Thus, specific reason chit reserves limit the endeavors and costs.

Online Chit Funds

In this advanced time, chit reserves have been redesigned and are even accessible on the web. These sorts of assets put together internet based barters. Besides, month to month commitments of the bidders and the award cash installment are made through internet based mode. Every part should have a web-based record to flow and oversee chit reserves.

Registered Chit Funds

The Enlistment center of Firms, Social orders and Chits offers enrollment to these chit reserves. The Hold Bank of India directs such assets by upholding the Chit Asset Act, 1982 all through India.

Unregistered Chit Funds

Partners, family or companions put together these assets, which go about as reserve funds plans. They are less secure when contrasted with enlisted chit reserves.

Click Also- DOPBNK Full Form Know

What are the Benefits of Chit Funds?

Chit funds are a unique form of mutual fund that allows users to invest small amounts of money in a variety of stocks, bonds, and other financial assets. These funds are typically managed by a third-party custodian, who manages the investments in accordance with specific investment guidelines set by the fund’s sponsor. Users can expect to earn high returns as the value of their investments grow over time, thanks to the diversification and risk management offered by chit funds.

Chit funds are an excellent way to build wealth and diversify one’s portfolio without having to manage individual investments manually. Additionally, chit funds are often free or low cost to use, making them a great option for investors on a budget. With so many benefits, it is no wonder that chit funds are rapidly gaining popularity among investors worldwide.

Chit funds can be beneficial to you in the following ways:

Multiple Usages

These funds can be used for a variety of things, like the education of your children, attending festivals, religious ceremonies, paying for medical bills, traveling, shopping, and getting married.

Low-interest rate

Bidders decide the pace of interest commonly; it varies from one sale to another. Moreover, chit subsidizes keep lower loan fees for borrowers when contrasted with different agents.

High Dividend

Financial backers get a nearly higher profit than interests procured on the reserve funds in different store plans.

Urgent Cash

You can get to moment cash during a monetary crisis or meet an unexpected cost. You additionally get the opportunity to acquire the pot (singular amount sum) subsequent to paying your most memorable portion.

No Queries

A candidate doesn’t have to uncover why he/she is getting the cash (the pot).

Collateral-free

You can get cash without promising any resource as guarantee. It will just rely upon individual guarantees, dissimilar to NBFCs and banks that require substantial security.

Less Or No Paperwork

It meets the monetary necessities of individuals without requesting subtleties, for example, a Dish card and IT returns.

Also Read- Haryana Scholarship 2024

Things to Consider Before Investing in a Chit Fund

Chit funds are a great way to invest your money without having to deal with the hassles and risks of trading stocks, bonds, and other securities. Chit funds are essentially mutual funds made up of small amounts of money from many investors. The returns on a chit fund are typically higher than those offered by traditional mutual funds because there is greater risk-sharing among the fund’s investors. This means that if one investor’s investment loses value, another’s may gain, resulting in overall gains for the fund. Chit funds also provide diversification benefits as each investor’s stake in the fund is different from every other investor’s.

Before contributing to a chit fund, there are a few things to take into consideration:

- You need to make sure that the chit fund is a legitimate business. To confirm the validity of the companies’ incorporation certificates, you can approach the registrar.

- Make sure to check the certificate issued by the registrar of the state where the chit fund company operates as well as the registration number.

- Don’t forget to learn more about the people in charge of the chit fund. You should pay more attention to their financial situation than you might think.

- Using the foreman’s commission as a basis, you can compare various chit funds. It would be prudent to select a chit fund that charges the lowest commission.

- Make sure you have the money to continue contributing throughout the chit fund cycle before investing in one.

- At the Registrar of Chits of the respective State Government, check to see if the chit fund company is the subject of any pending legal proceedings.

Conclusion

Chit fund 2024 is a unique investment opportunity that provides high returns but with low risk. Chit funds are mutual funds that invest in government securities such as bonds and debentures. These securities are typically issued by the government to raise money for public-sector projects and are considered a stable, reliable, and relatively safe investment option.

In Chit fund 2024, you can invest in a variety of chit funds offered by different financial institutions. Each chit fund has its own investment strategy and objectives, so you can select one that suits your needs and risk tolerance. Some chit funds may focus on long-term capital growth while others may offer higher returns in exchange for greater short-term volatility. Some Chit funds may charge management fees while others may charge performance fees based on the performance of the fund. Overall, Chit funds provide a way to diversify your investments while also enjoying reasonable rates of return.

Related Post-

How To Become A Software Architect 2024?