How to Close HDFC Bank Account Online- It is well-known for its management and customer service. But according to the new government rules, you have to always keep a certain amount in the bank account. The urban area’s fundamental requirement is Rs. Rs. 5,000 for rural areas. 3000. The bank will impose a base amount maintenance fee on you in the event that you are unable to maintain the base record balance. It might be difficult to maintain the base record balance across all of your bank accounts if you have multiple records in different banks.

Keeping up with changing or closing your bank account is the easiest way to remove the most money from maintenance costs. The process of closing an account is fairly straightforward. You must adhere to a brief procedure. Accepting at least for now that you’re searching for how to Close the HDFC account, this is the way you can make it happen. if you close your HDFC bank account without giving the bank proper consent, it could also result in the loss of certain banking services such as overdraft protection or transaction insurance coverage. So it’s important to consider all of these factors before deciding to close your HDFC bank account.

How to Close HDFC Bank Account Online

The HDFC bank offers excellent financial services and products to its customers. In any case, on the off chance that a record holder has numerous records with the bank, they could find it hard to keep up with and honor the base record balance necessity. In order to maintain clear and straightforward management, the account holder may be required to close the account. The process for closing an HDFC bank account is simple and painless. The bank has laid out the accompanying advances so the record holder can helpfully close a HDFC Ledger.

If you have multiple accounts with different banks, it might be difficult to keep the minimum balance in all of them. By balancing or closing your account, you can get rid of minimum balance charges in the simplest way possible. The procedure for closing an account is fairly straightforward. There are some steps you must take. If you’re looking for instructions on how to close an HDFC account, you can find them here. If you do decide to close your HDFC bank account, it’s best to take action immediately so that you don’t incur any additional fees or penalties. To help with this process, we offer 24-hour support and can provide step-by-step instructions on how to close your HDFC bank account online. If necessary, we can also assist with providing any relevant documentation required by the bank.

How to Close HDFC Bank Account Online Details

| Name Of Article | How to Close HDFC Bank Account Online |

| Close HDFC Bank Account Online | Click Here |

| Category | Trending |

| Official Website | Click Also |

HDFC Account Closing Details

Indian private banking and finance institution HDFC Bank has numerous locations. The bank is the best in India because it has millions of customers each year. HDFC Bank offers different administrations like:

- Loans (two-wheeler, personal, mortgage, and auto loans)

- Insurance policies,

- Mutual funds,

- Investments,

- Retail banking,

- Credit card

- Digital services

HDFC bank clients can enroll for various records in view of their current and future necessities. The bank offers a variety of accounts, some of which have zero balances and others that require regular maintenance. HDFC Bank is additionally open to shutting financial balances in view of client reasons. Wandering on the public authority’s upkeep expense rule, numerous HDFC bank clients might close their records. Any customer who doesn’t follow the rules will be punished by the bank. The customer, on the other hand, may decide to close their account for other reasons.

Read More- PM Kisan Aadhaar Link Status Online

HDFC Account Closing Charges

HDFC is the largest domestic bank in India and provides financial services to individuals, small and medium-sized businesses, and government agencies. It has a network of over 5,000 branches across the country and offers a variety of banking products and services. The bank charges fees for closing an account with HDFC. Depending on the type of account being closed and the reason for closing it, these fees may include account maintenance charges, non-interest-bearing overdrafts, and in some cases, penalties.

If you close your HDFC Bank account within 14 days of opening it, there will be no fees. A fee of Rs.500 or the lesser of the account balance and 15 days after opening or within 12 months of opening the HDFC Bank Account will be assessed.

| HDFC Bank Account Closure Charges | |

| Up to 14 days | No Charge |

| 15 days to 6 months | ₹ 500/- |

| 6 months to 12 months | ₹ 1,000/- |

| Beyond 12 months | No Charge |

Click Also- Canara Bank Account Balance Check via Net Banking

Other Reasons for Closing HDFC Bank Account

- if the client has more than one bank account.

- poor experience with customer service.

- Let’s say the client is moving to a different country.

- high fees for transferring money.

- A poor working relationship with a bank representative if the bank does not provide certain services.

- If one is unable to maintain the charge for maintenance.

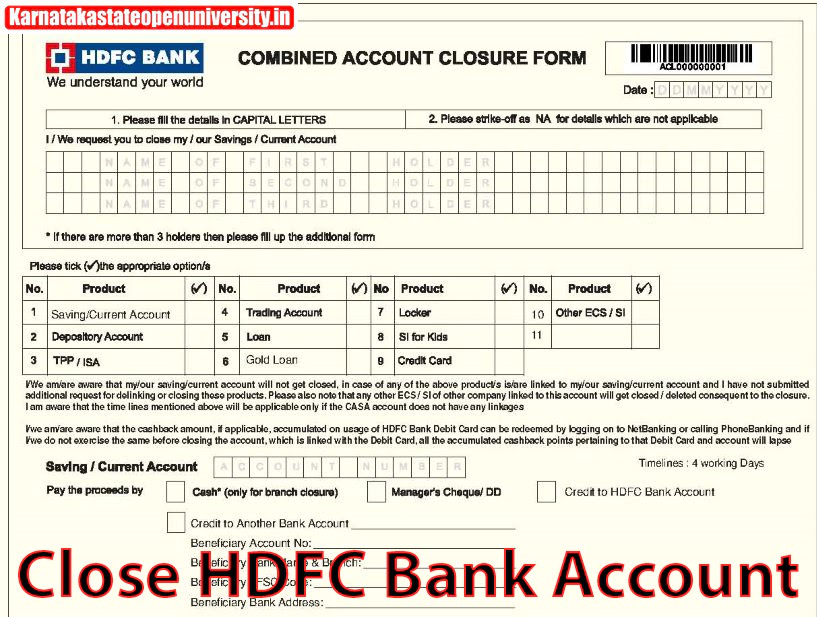

The user is required to present a number of proof documents in order to close their HDFC bank account. There is no online closing procedure at the bank. However, the closure form can be downloaded online, completed, and delivered to the HDFC bank branch closest to you.

Read More- Aadhar Card link with Mobile Number

Steps to Close HDFC Bank Account

If you have a close HDFC Bank account, we are here to help. For those of you who may not know, HDFC Bank is one of the largest financial institutions in the country, with more than 350 branches across India. And with such a large network, it is no surprise that HDFC Bank has a wealth of useful services and products for its customers. One of these services is the close HDFC account feature.

This feature allows you to close your HDFC bank account without penalty or fees. This way, you can choose to switch banks and take advantage of better rates and/or features offered by another institution. If you decide to close your account and move on, there will be no hard feelings – in most cases, HDFC will transfer all of your funds and balance into the new account without any additional charge or fee.

- To close your account quickly and easily, make sure that all of the money in it is gone. The most straightforward method for doing this is through net banking. Simply use NEFT, RTGS, or IMPS to move all of the money to another account. Your account’s balance ought to be zero.

- You can now approach the bank employee at the branch closest to you. The executive will provide you with an account closure form, which you should complete with accurate information.

- You can also take a completed form to the branch by downloading it from your home computer. You can now submit the account closure form to the executive along with the debit card, passbook, and chequebook by downloading it from the hdfc website at https://www.hdfcbank.com/.

- You should also bring an ID with you because the executive might ask for it in some cases.

- After that, the executive will give you a copy of the acknowledgement. You can keep the slip safe, and your bank account will be closed in ten business days.

Check Also- IDFC First Bank Account Balance Check

HDFC Customer Care

HDFC Customer Care, We are glad to receive your query. We understand that it can be stressful dealing with financial issues, especially when things go wrong. Our team is ready to help you find solutions and resolve any issues you may be facing. Our 24/7 customer support services are available to assist you with any questions or concerns you may have. Please feel free to contact us at any time, and we will be happy to help you with your query.

The record holder with any inquiries or necessities explanation in regards to the record conclusion strategy can contact HDFC client care. The record holder can contact the client care number-1800 202 6161 or 1860 267 6161. This number is open across India. The client care leader of HDFC Bank will help the client in settling every one of the questions in regards to the strategy to close a HDFC Financial balance or some other banking-related questions.

Conclusion

In this conclusion, If you have an HDFC bank account and want to close it, here’s how you can do so. First, send a written request to the bank stating your intent to close the account. Include your name, address, and contact information. You can also include a copy of the bank statement showing that you no longer require the service. Also, be sure to provide any relevant supporting documentation, such as canceled checks or other financial statements. Finally, be sure to give the bank a reasonable amount of time to process your request. If you do not hear back from the bank within a reasonable period of time, you can contact them and ask them why they are closing your account.

In that case, it might be time to close your HDFC Bank account. This is because you may be wasting money by keeping it open. When you have multiple accounts, it’s easy to get carried away with spending or forget to budget. Having a separate bank account for each category of spending helps you stay on top of your finances and make sure you’re not spending more than you can afford. So if you want to save money while maintaining a regular income, consider closing your HDFC Bank account and opening a new one with another financial institution.

Related Post-

How To Transfer Money From PhonePe Wallet To Bank Account 2024?