Top 10 Life Insurance Plans in India 2024 – The beneficiary of a life insurance policy can help ensure his family’s financial security in the event of his death. There are numerous life insurance policies offered by various life insurance companies on the market in India, making it difficult to choose the best policy. As a result, we at D2C Insurance Broking Private Limited—also known as “Renew Buy”—have conducted extensive research on the most effective life insurance policies in India and have made an effort to make it simple for you to select the most effective life insurance policy that meets your requirements. We’ll go over the various types of life insurance available in India and their advantages in the following sections.

A term insurance policy is a kind of life insurance plan that can be bought by a person for their own death. Under the policy, a specific duration and amount guaranteed are selected. The selected sum assured is paid to the deceased’s family by the insurance company if the life insured passes away during the plan’s term. The family is able to cope with their financial loss thanks to this one-time benefit.

Top 10 Life Insurance Plans in India 2024

Ghostwriting is a process of writing copy or other content for someone else, typically without credit. As the demand for ghostwriters continues to grow, there has been an increase in people looking to become ghostwriters. In this article, we will be discussing the top 10 life insurance plans in India 2024, so that you can make an informed decision about whether becoming a ghostwriter is the right career move for you. We will also provide information on the job market and how to get started as a ghostwriter. So if you’re interested in becoming a ghostwriter, read on!

A term plan offers protection in the form of financial support in the event of death, but only for a predetermined amount of time. The time span is chosen during the commencement of the strategy. It only applies to the policyholder, and the family receives the death benefit. The payout that the policy will make to your family when you pass away is known as the death benefit. The protection of your family’s future is the most important reason to purchase term insurance. It will give your family financial security and help with their needs. Your family will be able to live comfortably thanks to the payouts. Your family can pay off all of your debts. A term plan offers extensive coverage for a reasonable premium.

Top 10 Life Insurance Plans in India 2024 Details

| Name Of Article | Top 10 Life Insurance Plans in India 2024 |

| Top 10 Life Insurance Plans in India 2024 | Click Here |

| Category | Insurance |

| Official Website | Click Also |

What is Term Insurance?

A term insurance policy provides coverage for a predetermined amount of time, or the “term” of the policy. A death benefit is paid to the insured person’s nominees in the event that the insured person passes away while the policy is still in effect. With the exception of plans like Return on Premium and others, a basic type of term insurance has no cash value, which means that the policy does not return any value if the insured person survives the term of the policy. You can get a term insurance policy that will give your surviving spouse and children a certain amount of money in the event of your death. This money will allow them to maintain their current standard of living or pay off any outstanding debts without compromising their aspirations.

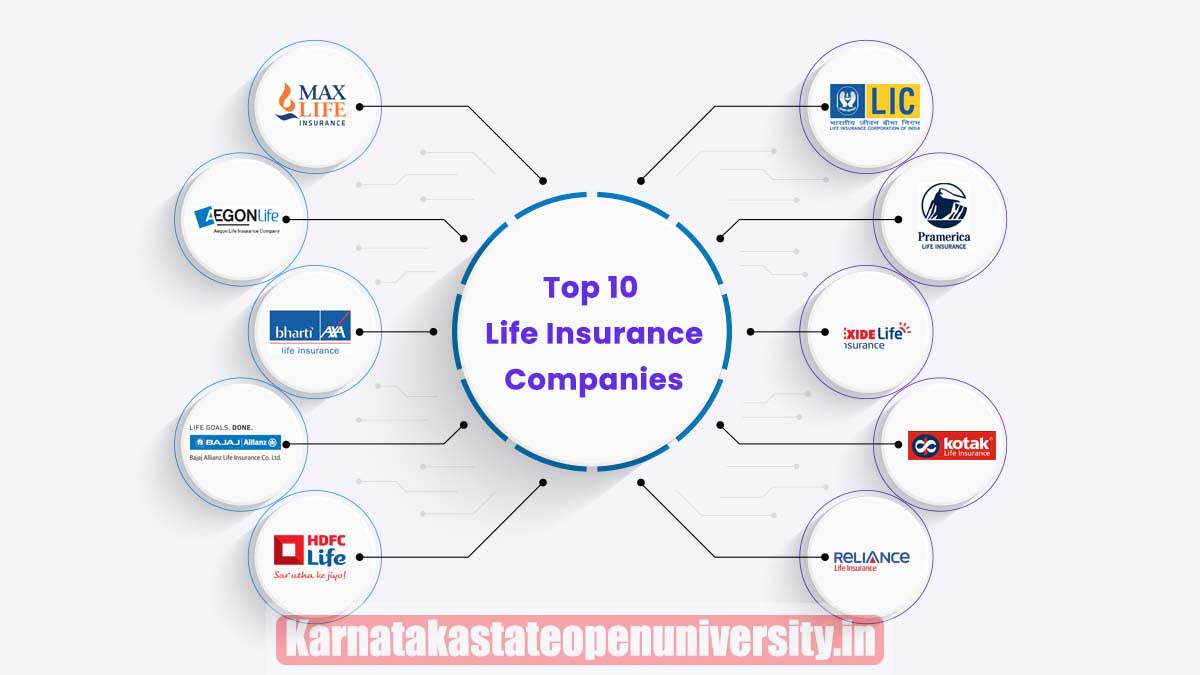

List of Top 10 Best Life Insurance Companies in India

The Top 10 Best Life security Companies in India are listed below:

- Max Life security Company

- AEGON Life security Company

- Bharti AXA Life security Company

- Bajaj Allianz Life security Company

- HDFC Life security Company

- LIC Life security Company

- Life Pramerica security Company

- Exide Life security Company

- Kotak Mahindra Life security Company

- Nippon Life security Company

Max Life Insurance Company

In India, Max Life Insurance is a major player in the industry. Max Financial Services Limited and Axis Bank Limited have formed Life Insurance Company Limited as a joint venture. The Max Financial Services Ltd. is a subsidiary of the Indian multinational corporation Max Group. Max Life Insurance provides individuals and organizations with a variety of life insurance products, including term insurance, return of premium insurance, annuity insurance, child plans, investment plans, money-back plans, and ULIPs. Max Life has maintained a substantial presence in the Indian market and positioned itself on the quality platform.

AEGON Life Insurance Company

One of India’s best digital life insurance companies is AEGON Life. AEGON N. V., a global provider of life insurance, pensions, and asset management, and Bennett Coleman & Company, India’s largest media conglomerate known as the Times Group, launched life insurance together. A variety of affordable life insurance policies are available from The Life Insurance Company. Their insurance plans are custom-made to protect you from rising post-death expenses. With AEGON Life insurance, you can rest assured that the individual requirements of you and your family will be met.

Bharti AXA Life Insurance

Bharti Enterprises, one of India’s leading business groups, and the AXA Group, which has its headquarters in Paris, collaborate to create Bharti AXA life insurance. It is one of the most important business groups in India, with interests in financial services, agriculture, and telecom. A wide range of insurance products are available from Bharti AXA Life Insurance Company. Savings plans, plans for children’s education, term insurance plans, ULIP plans, and so on are included. Customers benefit from Bharti AXA Life Insurance’s long-term value.

Bajaj Allianz Life Insurance

One of India’s leading private life insurance companies is Bajaj Allianz Life Insurance Company. It is a joint venture between Allianz SE, a European financial services company, and Bajaj Finserv Limited, which is owned by the Bajaj Group of India. Bajaj Allianz life insurance Company Limited has introduced novel insurance options that take into account the shifting requirements of customers over time. The Bajaj Allianz Life Insurance Company provides a wide range of life insurance products to various social groups.

HDFC Life Insurance

Housing Development Finance Corporation Limited is supported by HDFC Life Insurance Company Limited, a typical life insurance company. HDFC Ltd. and standard life Aberdeen, a global investment firm, are partners in the venture. HDFC life insurance offers innovative and customer-focused insurance plans that can assist our customers in safeguarding the future of their families and providing them with additional benefits like tax savings. It caters to a variety of customer requirements with a wide range of individual and group insurance options, including protection, pension, savings, investment, and health solutions.

LIC Life Insurance Company

The largest government-owned life insurance and investment corporation for individual insurance needs is Life Insurance Corporation of India (LIC).After collecting funds from individuals through life insurance policies, LIC’s primary function is to invest in global financial markets and other government guarantees. In the Indian market, LIC holds the majority of the life insurance business, while private life insurance companies hold a smaller share. Although LIC is India’s oldest and only government-run life insurance company, there are approximately 25 private life insurance companies competing for business in the Indian market. The significance of LIC Life Insurance lies in its ability to provide low-income and rural residents with financial protection against death at prices that are affordable.

Pramerica Life Insurance

Gurugram is where Pramerica Life Insurance Limited, formerly DHFL Life Insurance Company Limited, has its headquarters. Life Insurance is a joint venture between Prudential International Insurance Holdings and DHFL Investments Limited, a wholly owned subsidiary of Dewan Housing Finance Corporation Ltd. (DHFL).The company offers a wide range of individual and group life insurance options. The objective of Pramerica Life Insurance Company is to provide life insurance that is cost-effective, efficient, and effective. It meets a variety of financial protection requirements, including planning for retirement, saving money on taxes, creating wealth, and safeguarding their child’s future.

Exide Life Insurance

One of India’s top ten most trusted businesses is Exide Life Insurance. In the past, it was called ING Vysya Life Insurance Company. It is a private, non-profit life insurance company with its headquarters in Bengaluru. Over 15 lakh customers are served by the Exide Insurance Company, which is owned by Exide Industries Limited. The company has a solid traditional product portfolio and a track record of consistent bonuses in the insurance industry. Its primary focus is on providing plans for long-term protection and savings. The company offers need-based life insurance solutions in addition to life insurance.

Kotak Mahindra Life Insurance

One of India’s best and fastest-growing insurance companies is Kotak Mahindra Life insurance company limited. Old Mutual Limited, a pan-African investment, savings insurance, and banking group, and Kotak Mahindra Bank Limited formed the joint venture. It offers a wide range of financial products to suit individual and business investment requirements. Kotak life insurance safeguards your future and ensures that all of your investments continue to yield profit. The Kotak Life Insurance Company offers numerous low-cost life insurance policies.

Reliance Nippon Life Insurance

One of India’s leading private life insurance companies is Nippon Reliance Life Insurance Company Limited. The private-sector financial services and non-banking Nippon Reliance Life Insurance Company is an important part of Reliance Capital. Dependence Capital has enhanced organizations in protection, everything being equal, resource the board, shared reserves, business finance, and other monetary administrations. Dependence Life has an enormous assortment of extra security designs that offers tailor-made arrangements according to the clients’ prerequisites.

Top 10 Life Security Companies in India Based on Claim Settlement Ratio

| S.no | Life Insurance Companies | Claim Settlement Ratio | Solvency Ratio | |

| 1 | Max Life Insurance Company | 99.35 | 2.02 | BUY NOW |

| 2 | AEGON Life Insurance Company | 99.25 | 2.41 | BUY NOW |

| 3 | Bharti AXA Life Insurance Company | 99.05 | 1.78 | BUY NOW |

| 4 | Bajaj Allianz Life Insurance Company | 99.02 | 6.66 | BUY NOW |

| 5 | HDFC Life Insurance Company | 98.66 | 2.01 | BUY NOW |

| 6 | LIC Life Insurance Company | 98.62 | 1.76 | BUY NOW |

| 7 | Pramerica Life Insurance Company | 98.61 | 4.42 | BUY NOW |

| 8 | Exide Life Insurance Company | 98.54 | 2.24 | BUY NOW |

| 9 | Kotak Mahindra Life Insurance Company | 98.5 | 2.9 | BUY NOW |

| 10 | Reliance Nippon Life Insurance Company | 98.49 | 2.45 | BUY NOW |

How to Choose the Best Life Security Company in India?

The Best Life Insurance offers you a life risk cover that safeguards you and your loved ones in the event of an unanticipated circumstance. A type of insurance called life insurance provides a benefit to the insured upon their death. Any financial strategy must include life insurance. To safeguard your loved ones in the event of your death, you need to have the right life insurance policy.

The best way to find the right life insurance company in India is to look at their rates and pick the one that works best for you. Age, health, residence location, and other factors influence the rates offered by various businesses.

Tips to Choose the Best Life Insurance Company

There are a number of factors to take into consideration when selecting the best life insurance company. The policy’s cost is the most significant factor. The premium rates, the availability of a free quote, and your policy’s terms and conditions are additional considerations.

Here are some suggestions for selecting the best life insurance company:

- Compare quotes Online

- Check Company Financial Strength

- Check Company’s Benefits, and Features

- Look into Customer Reviews

- Know about the Company’s Terms and Conditions

- Know about Exclusions

- Look for additional riders

Also Read-Cowin App Download

How to Buy Best Life Security Policy from Best Company?

Life is unpredictable – we never know what could happen. That’s why it’s important to have life insurance in case something happens and you don’t have the means to support yourself. But choosing the right life insurance policy isn’t easy. There are a lot of options out there, and it can be tough to figure out which one is right for you. In this article, we’ll help you choose the best life security policy from the best company. We’ll walk you through the process step-by-step, so you can make an informed decision. Ready to get started? Let’s go.

A life insurance policy can be difficult to buy. Finding the right company can be challenging because there are a lot of things to think about. Follow the steps below to get the best life insurance policy from the best company.

- Go to the Official Insurance Website. Press on Life Tab

- Give the needs information such as name, date of birth, etc.

- Compare premium rates from the list of companies Given

- Select the plan which suits your Needs

- Given payment via online payments.

Related Posts :-