YES Bank RTGS Form Download 2024 – Large transactions are the primary use case for the RTGS system. RTGS transactions require a minimum payment of Rs 2 lakh. Form, Rules, Timing, Charges, and How to Use Yes Bank RTGS: You can instantly transfer funds to any Indian bank using Real Time Gross Settlement (RTGS). Your transactions are made simpler and can be carried out further and with fewer restrictions thanks to this service. Yes Bank offers RTGS service to its customers in a variety of ways and is RTGS enabled. By completing the Yes Bank RTGS Form, customers can use RTGS to send money.

YES Bank is one of the largest Indian banking and financial services group, based in New Delhi. It offers various services including loans, deposits, remittances, and insurance products. YES Bank is a highly regarded bank with a strong track record of providing excellent customer service. The bank has several branches across India as well as overseas locations in countries such as the United States. They also have an online banking platform that allows customers to manage their accounts and make payments from any devices.

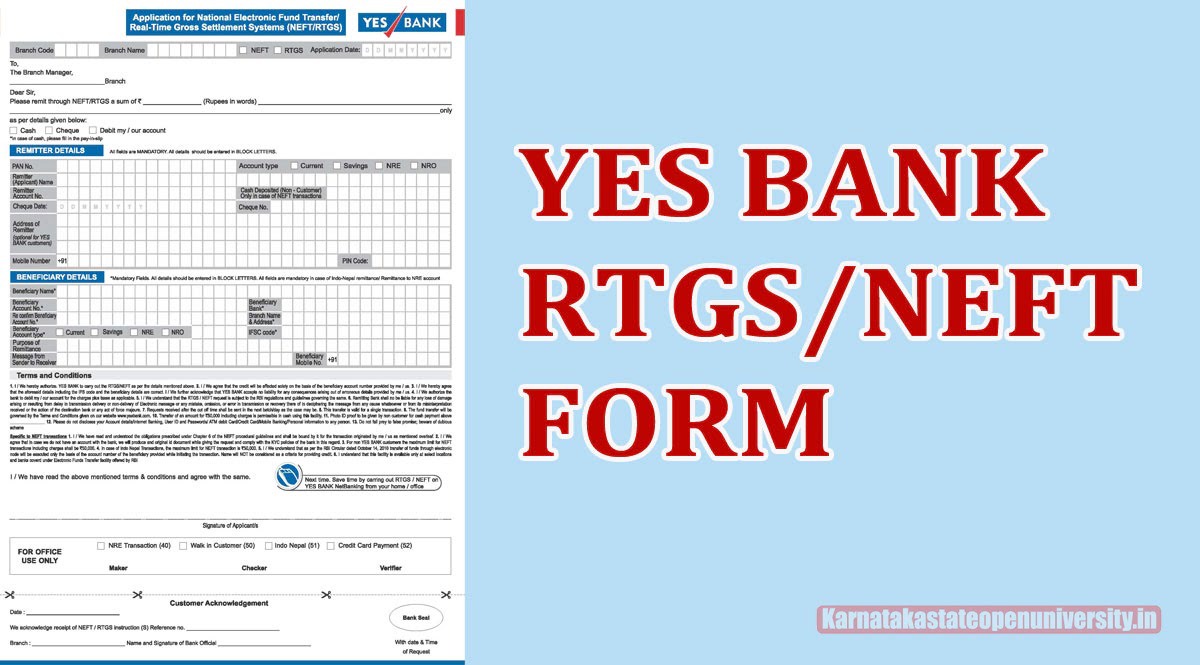

YES Bank RTGS Form Download 2024

For large-scale transactions, Real-Time Gross Settlement (RTGS) is a useful option. Amount holders can transfer funds to any other Indian bank. The Reserve Bank of India (RBI) will keep a record of each and every RTGS transaction. After being received, each transaction will proceed independently and immediately. If you have access to Internet banking or Mobile Banking, you can conduct RTGS online.

YES Bank has been providing financial services for over a century, and its reach is far-reaching. YES Bank can be found in almost every corner of the world, allowing customers to manage their finances from anywhere. Its online banking platform allows users to transfer funds easily, pay bills, and access their accounts from any device. Furthermore, YES Bank also offers various other services, such as insurance and investments, that can help you manage your financial life. Overall, YES Bank is a trusted and reliable bank that offers a wide range of services at affordable prices.

YES Bank RTGS Form Download Overview

| Name Of Article | YES Bank RTGS Form Download 2024 |

| YES Bank RTGS Form Download 2024 | Click Here |

| Category | Trending |

| Official Website | Click Also |

About Yes Bank

One of India’s private operating banks is the YES Bank; Since 2004, it is renowned for its distinctive banking and financial services. The RBI has complete control over the Bank, which is located in the private sector section. Yes, the bank offers services both online and offline. Customers can send and receive money using internet banking, RTGS, or NEFT. The Bank highly recommends the RTGS services for money transfers to various accounts due to their popularity, speed, and ease of use.

What is Real Time Gross Settlement, or RTGS? This is a banking system for digital money transfers. Within 30 to 60 minutes of authorizing a transaction, the service transfers funds from one account to another. The services let you transfer as little as RS 2 lakhs using RTGS. To get quick banking services, account holders should fill out the RTGS form.

Check Also:- What Are Consulting Jobs 2024?

RTGS/NEFT Time Limits and Prices

According to RBI guidelines, the RTGS time limit is the same for all banks. However, the service is not regulated around the clock, making it easy to transfer cash to any location. On weekdays, services are held from 7 a.m. to 6 p.m.; on Saturdays, services begin at 9 a.m. and end at 4 p.m. and 2:30 p.m., respectively. Sundays and official holidays are off limits for RTGS banking services.

YES Bank RTGS Form

The list of RTGS fees provided by the RBI varies slightly between banks.

- RTGS transactions in excess of 2 to 5 lakhs cost RS 25.

- RTGS transactions in excess of five lakhs are charged RS 50.

- The Bank provides free net banking and mobile banking services for RTGS payments.

Check Also:- What Is A Desktop publishing software Common Skills And Duties?

Details Needed For Filling Yes Bank New RTGS/NEFT Application Form PDF Download

When filling out the Yes Bank New RTGS/NEFT Application Form (PDF Download), customers should ensure that the following information is correct:

- Beneficiary Name,

- Beneficiary Bank Account Number,

- Account Type,

- Bank and Branch name and address,

- Purpose of Remittance,

- IFSC Code,

- Mobile number of the beneficiary

- Alongside, the form needs these applicant or remitter details:-

- Customer Name,

- Bank Account Number,

- Account Type,

- Address,

- Cheque or Cash details,

- Amount Remittance Details,

- Mobile Number,

- PAN Number

Check Also:- How To Write A back End Developer Resume?

How to fill YES Bank RTGS / NEFT Form?

First, check out all of the blocks in the form because there are more blocks there. You must carefully follow the steps below to fill out the form without making any mistakes.

- There are two blocks in the RTGS/NEFT form, as you can see. The “Remitter,” “Beneficiary Details,” and “Customer Acknowledgement Copy” are all mentioned in the first and third blocks, respectively.

- Input the name of the branch, the code for the branch, the mode of transfer, which could be RTGS or NEFT, the application date, the amount to be remitted, and the mode of remittance, which could be cash, a check, or an account.

- Complete the details, such as the remitter’s and beneficiary’s information.

- In the first block, which is labeled “Remitter details,” enter the PAN number, account type, name of the sender, account number, account type, date of the cheque, and number, as well as the mobile number, address, and pin code of the sender.

- The Beneficiary Name, Account No., Beneficiary Bank, Branch Name, Account Type, Address, IFSC Code, and Mobile No. are all written in the second block titled “Beneficiary details.”

- Before submitting the form, be sure to read it carefully and sign it before giving it to bank employees.

- In order to process the transactions, bank employees must verify and sign the column labeled “For Branch/Office-Use Only.”

- A customer copy that the applicant receives from the bank after completing the transactions includes the applicant’s name, transaction ID, and signature so that it can be use in the future. This is the third and final block for “Customer Acknowledgement.”

Related Post:-