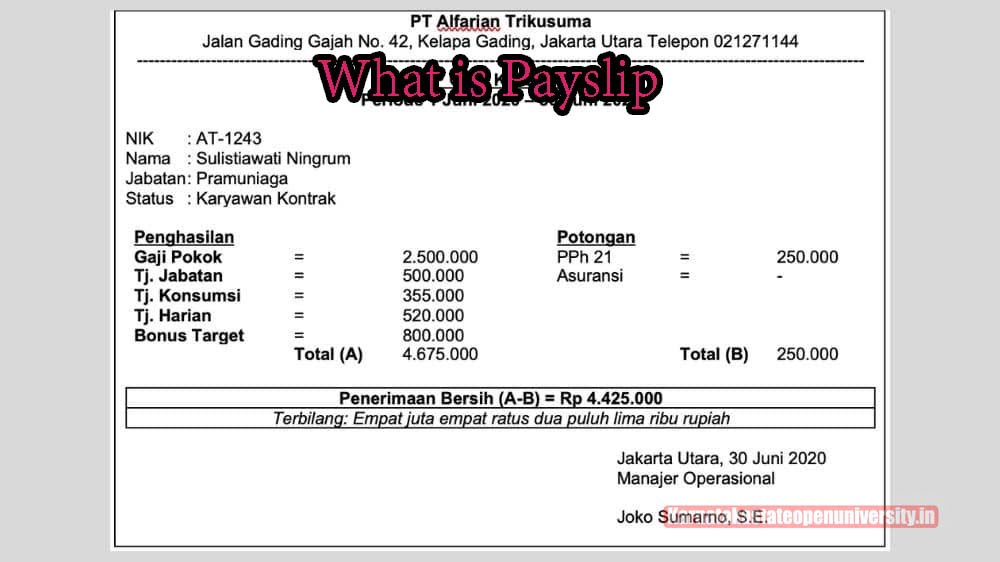

What is Payslip- A payslip is a document that every employee receives from their employer, but few people realize how important it is. Do you often feel uneasy about common terms like gross pay, tax credits and refunds? Don’t worry! Here we will discuss the important aspects of payroll.

This is the document that all companies must provide to their employees on a monthly basis. The receipt contains information about the employee’s deductions and basic salary for a particular month. This serves as proof of payroll and is usually provided by your employer in both hard copy and paper form.

What is Payslip

A payslip or payslip is a document that an employee receives from their employer every month. This includes key compensation details, from gross pay, deductions and TDS details to net take home pay for a given month. After your employer pays your salary, you will receive a monthly payslip. When changing jobs, it is important to know the salary calculation in order to negotiate repeatedly at the new job and secure a better salary.

A payslip is a document that an employee receives from their employer every month. Everything from gross pay to net take-home pay to deductions is shown. After your employer pays your salary, you will receive a monthly payslip. When changing jobs, it’s important to know your payroll so you can negotiate and secure a better salary at your new job.

What is Payslip Overview

| Name Of Article | What is Payslip |

| Year | 2024 |

| Category | Pay slip |

| Official Website | Click here |

Components of a salary slip

A payslip clearly shows the amount of salary being paid, the types of benefits and incentives offered by the employer, and various other details. Additionally, you can use the documentation to find out what tax credits are available. This is a list of the most important parts of your payslip/payslip.

A salary slip is a document that details the wages and other payments received by an employee. It can include information such as the employee’s name, address, pay period, and total compensation. The salary slip also may include other important details such as deductions for taxes and benefits, as well as any bonuses or additional payments made to the employee. The components of a salary slip can vary depending on the type of employment but typically include.

Income statements

- Basic salary

- House Rent Allowance (HRA)

- Dearness Allowance (DA); it is only for public sector employees

- Medical Allowance (MA)

- Conveyance Allowance (CA)

- Special Allowance (SA)

- In-hand salary

- Cost to Company (CTC)

Deductions

- Professional tax

- Employee Provident Fund (EPF); it is only for private sector employees

- Tax Deducted at Source (TDS)

Difference between CTC and in-hand salary

CTC is the total amount a company spends on its employees. This includes HRA, CA, medical bills, tips, EPF, and other benefits. It depends on various factors that affect your net salary. CTC can be thought of as an employer’s total cost of hiring an employee.

Gross salary is the amount you receive before deductions. Employers deduct bonuses and PF from this income. Your payslip does not show your gross salary. It will only be mentioned in your offer letter. Finally, the amount after deducting taxes and other deductions is called take home or take home pay. On hand salary is always lower than CTC because he receives it after deductions. Let’s understand the difference with the illustration.

Check Also:- ITBP Pay Slip 2024

Details about salary slip components

Salary slip is a document that records the salaries of employees. It is usually prepared by the employer and helps them calculate their payroll expenses. The components of a salary slip include the employee’s name, address, contact information, position, and salary. A salary slip may also include other information such as bonus payout, benefits package, tax deductions, and bonus targets. In addition to being used by employers to calculate their payroll expenses, salary slips are also used by employees to manage their finances and plan their financial future.

The income section of a payslip includes components such as:

1. Basic salary

It is the basic component of salary and accounts for up to 50% of total salary. Early in your career, this section contains more money, but as you grow and reach higher designations, the base percentages decrease to ensure you’re below your total allowance. I recommend negotiating a higher base salary.

2. Dearness Allowance (DA)

DA is an allowance paid by public sector employers to their employees to help them cope with the effects of inflation. This amount is based on living expenses and may vary by location. DA is a percentage of base salary and is taxable.

3. House Rent Allowance (HRA)

An employee’s payslip also includes an HRA, an allowance that employers pay to employees living in rented housing. Currently, HRA is 50% of base salary if you live in big cities like Kolkata, Mumbai, Delhi, Chennai. 40% in all other cities.

4. Conveyance Allowance (CA)

CA is the amount a company pays an employee to commute to work. Up to ₹19,200 tax exemption per year was available until 2018, but is no longer available. Instead, a standard deduction of INR 50,000 is applied.

5. Medical Allowance

Employers pay each worker this allowance during their tenure to cover medical expenses. This also applies to standard deductions.

6. Leave Travel Allowance (LTA)

Your employer will pay this amount for your and your family’s travel expenses during the vacation period. Generally only rail and air fares for travel within India are covered. You must provide proof of travel to receive your LTA. You can also get a tax exemption on that amount, but only for a maximum of two vacations in blocks of four years.

7. Special Allowance (SA)

SA is another allowance included in your monthly salary and its value depends on your job performance. Companies have introduced this allowance to improve employee performance. The amount varies by vendor. The entire SA is taxable.

Check Also:- Paymanager Rajasthan Employee Pay Salary Slip

The deduction section of the salary slip includes

The deduction section of the salary slip includes various deductions that an employer can make from an employee’s paycheck. These include Social Security, Medicare, federal and state income taxes, and any other applicable federal and state taxes. In addition, employers may also deduct a portion of an employee’s compensation for retirement plans such as a 401(k) or a traditional pension plan.

The remainder of the salary is then typically used to cover the employee’s basic living expenses such as housing, food, transportation, and utilities. Other common deductions may include union dues and other voluntary contributions that employees may be required to make to benefit programs or services provided by their employer. In addition to the salary deductions, employers can also make additional payments to employees through bonuses or commissions based on performance or specific goals met by the employee.

1. Professional tax

West Bengal, Karnataka, Andhra Pradesh, Maharashtra, Telangana, Tamil Nadu, Assam, Gujarat, Chhattisgarh, Meghalaya, Kerala, Jharkhand, Orissa, Tripura, Madhya Pradesh , Bihar and other state governments impose this tax on all income professionals. The tax amount is typically around INR 200 per month.

2. Tax Deducted at Source (TDS)

Your employer will deduct this tax from your income and submit it to the government. The amount depends on the income tax table and can be found on the electronic income tax registration portal.

3. Employee Provident Fund (EPF)

Private sector employers may offer EPFs as an investment opportunity for employees to save and set up a retirement fund. As an employee, you must contribute her 12% of your base salary. Employers also contribute the same amount. Section 80C of the Income Tax Act, 1961 allows an annual tax exemption of up to INR 1.5 lakh on contributions to the EPF.

Check Also:- IFHRMS Login 2024

Why is the pay slip important?

The pay slip is an important document because it tells you – the employee – how much you are paid and how that money is broken down. It can help you understand your salary better, make informed decisions about your pay, and plan for future expenses.

The pay slip also serves as a record of your earnings, which may be useful in case of disputes or audits. Plus, it’s a good way to keep track of your income and ensure you’re not being overcharged or underpaid!

So, why is the pay slip such an essential part of the workplace? It’s all about accountability and transparency! The pay slip shows exactly how much you earn and where that money comes from. And that helps ensure that everyone is being fairly compensated for their work.

An employee’s payslip is a legal working document and serves a variety of purposes such as:

1. Employment certificate

A certificate of employment. You will need to present a copy of it when you apply for your travel visa. It is also required as evidence for background checks and payroll claims.

2. Tax planning

Payroll helps with tax planning, an important part of finance. Efficient tax planning can reduce tax outflows. You can also check if you are eligible for rebates and benefits under the Income Tax Act 1961.

3. Availing of loans and subsidies

Your payslip shows your current job title and salary, both of which indicate your ability to repay the loan. Therefore, both lenders and credit card companies must provide copies in order to obtain a loan or credit card. This document also allows you to claim government subsidies for grain, medical services, and other utilities.

Once you understand the use and importance of your payslip, we recommend that you carefully keep a copy for future needs.

Related Post:-