NPS Login & National Pension Scheme- In the beginning, the National Pension System (NPS), formerly known as the New Pension Scheme, was made available to government workers who were eligible for a pension from the government. However, the policies of the scheme needed to be changed, and it was eventually made available to all Indian residents. All government employees are required to participate in the NPS pension plan, while others can choose to do so on their own.

The Indian government launched the investment-cumulative NPS (National Pension Scheme), which is governed by the PFRDA (Pension Fund Regulatory and Development Authority). India has always been a country where only government workers could get a pension when they retired, but the government wants to make this financial security available to all citizens through the NPS scheme after retirement. Employees in the private sector, self-employed professionals, and even employees in the unorganized sector, with the exception of those in the armed forces, are eligible to take advantage of the National Pension Scheme. The minimum contribution under this plan is Rs. 6,000 throughout a fiscal year; Subscribers have the option of paying it all at once or in monthly installments of at least Rs. 500.

NPS Login & National Pension Scheme

The Indian government launched the investment-cumulative NPS (National Pension Scheme), which is governed by the PFRDA (Pension Fund Regulatory and Development Authority). India has always been a country where only government workers could get a pension when they retired, but the government wants to make this financial security available to all citizens through the NPS scheme after retirement. Employees in the private sector, self-employed professionals, and even employees in the unorganized sector, with the exception of those in the armed forces, are eligible to take advantage of the National Pension Scheme. The minimum contribution under this plan is Rs. 6,000 throughout a fiscal year; Subscribers have the option of paying it all at once or in monthly installments of at least Rs. 500.

The National Pension Scheme (NPS) is a government-sponsored retirement savings programme in India. It was launched in 2006 and is administered by the Ministry of Labour and Employment. The NPS allows individuals to deposit money into a retirement account to save for their later years. The scheme provides a variety of investment options, including equity and fixed income, with the potential for high returns. Individuals can also choose how much money they want to contribute, which will be deducted from their salary or income. With the NPS, individuals can take advantage of government-backed security and peace of mind as they approach retirement.

Details NPS Login & National Pension Scheme

| Name Of Article | NPS Login & National Pension Scheme |

| NPS Login & National Pension Scheme | Click Here |

| Category | Govt Schemes |

| Official Website | Click Also |

Key Features and Benefits of National Pension System

The National Pension System (NPS) is a centralised, mandatory, and comprehensive scheme in the country to provide retirement security for all citizens. The NPS was launched in 2016 by the Government of India to provide a uniform pension scheme for all citizens, regardless of their place of residence or employment status. The NPS offers several key benefits to its members, including guaranteed income in old age, protection against financial hardship in later life, and affordable lifetime expenses. In addition, the NPS is designed to encourage savings and promote economic growth by encouraging individuals to build up funds for future consumption. This system is a step towards improving the well-being of the nation’s population and providing them with greater security in old age.

- Subscribers can change the amount they want to save each year and contribute to their NPS Account at any time during a financial year.

- Through eNPS or any of the POPs, which are also referred to as Point of Presence, subscribers can open an account.

- Subscribers can select their preferred pension fund and investment option.

- Accounts can be accessed by subscribers from any workplace or location.

- Investment guidelines are transparent because PFRDA regulates them, and the NPS Trust regularly monitors fund managers.

Check Here- Vidhwa Pension List UP sspy-up.gov.in

National Pension System Registration Process

The National Pension System (NPS) is a government-sponsored retirement program in the Philippines that provides benefits to eligible members. The NPS registration process involves completing several steps, including filling out an application form and submitting required documents. Individuals must first register to become members of the NOS by submitting a valid birth certificate and proof of residence.

Individuals must also provide information about their employment history, including their employer and the years they worked for the company. Additionally, individuals must provide evidence that they are at least age 18 or older, such as a valid government-issued ID card or driver’s license. Individuals must also provide details about their income, such as their gross monthly salary or pension from their employer. After completing the registration process, individuals will receive an identification number that can be used for accessing their contributions and benefits.

Online Process for NPS Registration

While making an enrollment online to open another NPS account, you want to follow the underneath steps:-

- Pick the NPS model you wish to apply for – state government, focal government, corporate or confidential resident.

- Fill in your own as well as expert subtleties, for example, name, date of birth, address, contact subtleties, instructive capabilities, calling, pay and that’s only the tip of the iceberg.

- Fill in your ledger subtleties like record number, IFSC code, branch, MICR code and the sky is the limit from there. Give subtleties of the candidate.

- In the event that you need to open one record, pick a Level II record. The NPS enrollment opens a Level I account naturally.

- Pick your annuity store director out of the eight choices currently.You can choose only one.

- Select the proportion you might want to go with while putting resources into various protections.

Click Here- SBI HRMS Login, SBI Balance Check

Offline Process for NPS Registration

If you choose to apply in person, you must bring a completed NPS registration form, your most recent photograph, and a check or demand draft to the NSDL branch closest to you. A PRAN, or Permanent Retirement Account Number, will be sent to you if you submit your registration form offline at the NSDL office. It is your NPS account’s identification number, which you will use to complete all account-related transactions.

NPS Login

Whenever you have made your NPS account and accepted your PRAN number, the E-NPS record can be signed in through channels, for example, the NSDL NPS gateway, the KARVY entrance or through a web banking account. If you want to visit a national park but don’t already have a passport, you can apply for one online or in person at any US National Park Service visitor center. You can also call the NPS Customer Service Center for more information about obtaining a passport.

To access National Parks and other federal lands, you must have a valid NPS Passport. The passport is available online or at any US National Park Service visitor center. You can also get a passport by visiting a local NPS office or by calling the NPS Customer Service Center. In some cases, members of certain organizations may be granted special access to certain parks. For example, some groups may receive an NOS Passport that gives them access to certain national parks without the need for a regular passport.

Check Also- TN ECS Portal Payslip Pension Status Treasury

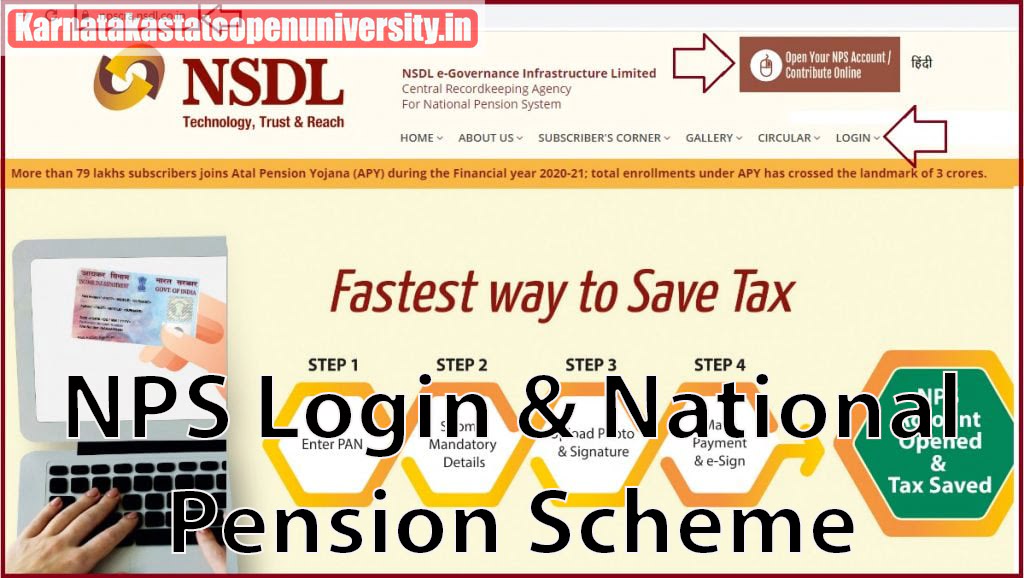

Using NSDL NPS Portal

Using the NPS portal is a great way to manage your network configuration and security settings. The NPS portal provides a centralized location where you can view, manage, and troubleshoot network settings for your organization.

To access the NPS portal, you can use your corporate credentials or an account created specifically for the NPS portal. Once logged in, you can access different sections of the portal to troubleshoot connection issues and configure security settings for your network. Some of the sections in the NPS portal include:

- Go to the official website of NSDL NPS at www.npsra.nsd.co.in

- Select the “open your NPS Record/Contribute On the web” button

- Presently click on the “Login with PRAN/IPIN” button

- Then the sign in screen will show up.

- When you have your PRAN and Secret word, fill these subtleties in the necessary field and snap on the “Submit” button to gain admittance to your E-NPS account.

It is required to create a new password to login into the account for the first time by following the below steps:

- Go to the authority site of NSDL NPS at www.npsra.nsd.co.in

- Select the “open your NPS Record/Contribute On the web” button

- Presently click on the “Login with PRAN/IPIN” button

- Then, at that point, the sign in screen will show up.

- Then, at that point, click on the “Secret phrase for e NPS” interface that will assist you with producing another secret word.

- Whenever you have opened the connection, give subtleties like PRAN number, date of birth, new secret phrase and affirm secret phrase. Then, at that point, enter the manual human test.

- Click on the submit button subsequent to filling in this large number of subtleties.

- An OTP will be shipped off your enlisted portable number. Enter it to affirm the new secret phrase.

- Whenever you have entered your PRAN number and the new secret phrase, you can sign in to your E-NPS account.

Check Also- TS PRC Minimum Pension/ Family Pension

Using Karvy NPS Portal

Karvy NPS is a web-based tool that can be used to collect and manage data from a large number of respondents. It can be used to collect data from individuals, groups, or populations. The tool enables users to customize the survey, including the format and length of the questions, and the method of data collection (e.g., online, phone, in-person, etc.). Once the survey has been completed and submitted, Karvy NPS provides users with a summary of responses and statistical analyses. This helps users gain a better understanding of their audience’s thoughts and feelings on a particular topic.

Using Karvy NPS Portal to perform a managerial performance evaluation is a great way to get an objective assessment of an employee’s performance. The portal allows users to easily manage their projects and perform detailed analysis on the data. Users can create different reports and charts, making it easy to see the trends and make informed decisions.

- Go to the Karvy NPS portal’s official website

- Click the button labeled “Login for existing subscribers.”

- Now you will see the login screen.

- Then, enter your PRAN number and password to access your E-NPS account.

Follow the below steps in case you are logging in for the first time:

- Select the connection – “Snap here to create secret key… .reset your secret phrase”.

- Here, fill in the subtleties like your PRAN number and date of birth. Then, enter Manual human test.

- An OTP will be shipped off your enlisted versatile number whenever you have tapped on the submit button.

- You can now set another secret word by utilizing the OTP.

- Then sign in to your E-NPS account once the new secret phrase is made.

With the Help of Internet Banking

Several banks provide access to the E-NPS account via internet banking. To login to NPS online using internet banking, follow these steps:

- Sign in to your internet banking account.

- Check the details of your account on the NPS page.

- You will be able to make contributions, select plans, and carry out account-related actions from the screen of your internet banking account.

Click Here- LIC Varishtha Pension Plan

How to Reset the Password on NSDL NPS Portal?

This article will help you reset your NSDL NPS Portal password and provide you with information on how to do so. In order to reset the password for your NSDL NPS Portal account, you must first log in to the portal using your credentials. Once you are logged in, select the ‘Account’ option from the menu bar at the top of the page.

From there, select ‘Password & Security’ from the menu bar. This will take you to a page where you can change your password and other account settings. Finally, select ‘Forgot Password?’ and enter your existing email address and a valid email address for notifications. You will receive an email with instructions on how to reset your password.

Even if you haven’t logged in to your account yet, you can still generate a new password by following the steps listed below:

- Navigate to the welcome page on the NPS official website to sign in.

- Select the “Forgot Password” button.

- Click on “Moment Reset I-PIN”

- Presently fill in the expected subtleties like your PRAN number and date of birth.

- Make a fresh password.

How to Reset the Password on Karvy NPS Portal?

To reset the password on Karvy NPS portal, you will need to navigate to the ‘Password settings’ section of the portal. Here, you can select the ‘Reset password’ option to have your password reset. This will allow you to enter a new one and reset your account’s security settings. However, be sure to choose a strong and unique password to keep your data secure. In addition, it is recommended that you change your password regularly to ensure its security.

Follow the underneath moves toward produce another secret phrase on KARVY NPS Entrance:-

- Go to the authority site of Karvy NPS gateway at e-f[dot]karvy[dot]com

- Click on the “Login for existing endorsers” button

- Presently the login screen will show up

- Then, at that point, sign in to your E-NPS account by entering your PRAN number and date of birth and Manual human test.

- An OTP will be shipped off your enrolled portable number whenever you have tapped on the submit button.

- You can now set another secret phrase by utilizing the OTP.

- Then sign in to your E-NPS account once the new secret key is made.

Also Read- Amma Vodi Scheme Application Form

NPS Helpline Customer Care Number

NPS Helpline Customer Care Number is 022-2499 3499.

How to Download the NPS Application?

The NPS Application is an online form that allows you to provide information about your organization and its mission, goals, and activities. It is used by the National Park Service (NPS) to select organizations for special recognition, such as National Historic Landmarks or National Heritage Sites. The application is usually required for organizations seeking recognition for their work in national parks and monuments. It is often required for events, programs, and activities in national parks and other protected areas.

Follow the beneath moves toward download the NPS Application on your versatile:-

- Go to the Application Store (for iPhone clients) or Play Store (for android clients) on your cell phone.

- Search the application NPS by NSDL e-Gov and download it.

- Whenever you have downloaded the application, sign in to it utilizing the PRAN or Super durable Retirement Record Number and the PIN you got with the PRAN invite pack.

Read More- Kisan Vikas Patra Scheme Application Form KVP Yojana

Conclusion

The National Pension Scheme is a government-sponsored pension plan in India that provides retirement benefits to Indians who are unable to provide for themselves. To participate in the NPS, individuals must first register with their local government office or a financial institution that administers the scheme. Once a person has registered, they can contribute money into their account and receive payment upon retirement. The National Pension Scheme is overseen by the National Pension Commission (NPC), which is an independent agency responsible for managing the fund’s investments, investments, and distributions.

To access your pension funds through the National Pension Scheme, you will need to have an account with a financial institution that administers the scheme in your area. This can be done through a variety of methods, such as bank accounts, mobile wallets, or online platforms such as Karvy Wealth. Most people choose to open an account with a bank or financial institution because these institutions are often more trustworthy and secure than individual investment platforms. It is also possible to set up an NPS account on Karvy Wealth if you do not already have one there.

Related Post-