IndusInd Bank Pioneer Heritage Credit Card- The first metal credit card issued by the bank in collaboration with Mastercard is the IndusInd Bank Pioneer Heritage Metal Credit Card. Customers with extremely high net worth, particularly affluent Indian professionals and entrepreneurs, are the best candidates for this card. The card provides benefits in a variety of areas, such as wellness, lifestyle, and travel, among others. The card’s in-depth features and benefits are listed below. The Pioneer Heritage Credit Card from IndusInd Bank is designed specifically for wealthy individuals. You can redeem reward points and earn reward points by swiping your card. People utilizing this card will get amusement advantages and will likewise gain admittance to choose homegrown and global parlors.

The IndusInd Bank Pioneer Heritage Credit Card is an excellent option for individuals looking for a credit card with a range of benefits and rewards. With this card, customers can enjoy a host of features such as fuel surcharge waivers, dining benefits, and accelerated reward points on select transactions. Additionally, this card comes with a personalized concierge service, which can help customers with anything from travel to dining reservations. The card is also equipped with advanced security features such as Zero Fraud Liability and One Touch Contactless payment for added security and convenience. IndusInd Bank Pioneer Heritage Credit Card is a great choice for anyone looking to maximize the benefits of their credit card.

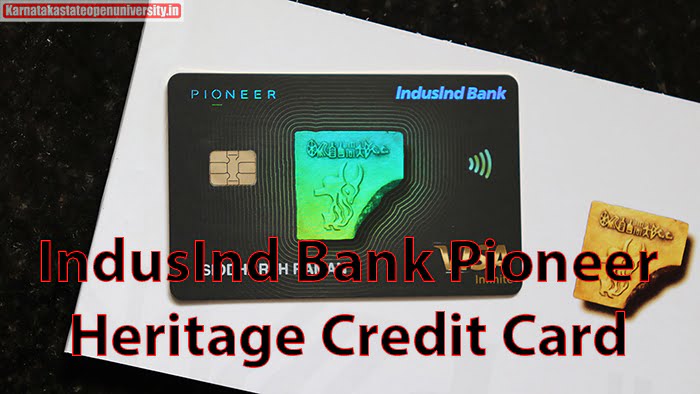

IndusInd Bank Pioneer Heritage Credit Card

The first metal card issued by the bank in partnership with Mastercard is the IndusInd Bank Pioneer Heritage. The card is the best option for all customers with high net worth, such as established Indian professionals and business owners. The card provides a plethora of benefits in a variety of areas, such as wellness, lifestyle, and travel, among others. The card’s in-depth features and benefits are listed below. Check out the following cards from other well-known banks if you think that the IndusInd Bank Pioneer Heritage Metal Credit Card, which is a premium credit card, doesn’t offer a decent reward rate or has an excessively high annual fee.

If you’re looking for a credit card that offers a wide range of benefits and rewards, you might want to consider the IndusInd Bank Pioneer Heritage Credit Card. This card offers a host of advantages, including access to exclusive lifestyle experiences, travel privileges, and dining discounts at select restaurants. It also comes with a number of value-added services, such as insurance coverage and emergency assistance. Plus, with its easy application process and 24/7 customer support, getting this card is a breeze.

Details IndusInd Bank Pioneer Heritage Credit Card

| Name Of Article | IndusInd Bank Pioneer Heritage Credit Card |

| Years | 2023 |

| Category | Trending |

| Official Website | Click Also |

About IndusInd Bank

One of India’s most well-known banks, IndusInd Bank provides a variety of services to its customers, including credit cards, loans, and savings accounts. Yet, here we will examine the IndusInd Bank Visas since there are numerous cards with various highlights and advantages. Each charge card has its significance and you can apply for it online according to your necessities. To determine whether you are qualified to apply for any of the cards, you can review their features and benefits. The IndusInd Bank offers a wide range of credit cards, including luxury credit cards, shopping credit cards, and travel credit cards. As a result, before choosing a credit card from IndusInd bank, you must review all of the options.

IndusInd Bank is one of India’s leading private sector banks, offering a wide range of financial products and services to customers across the country. Founded in 1994, the bank has grown over the years to become a trusted name in the industry, known for its innovative approach to banking and customer-centric focus. With a network of more than 2,000 branches and ATMs, IndusInd Bank is committed to providing its customers with the highest level of service and support, whether they are looking to open a new account, apply for a loan, or manage their finances online. Some of the key services offered by the bank include personal banking, business banking, wealth management, and investment services. If you’re looking for a reliable and customer-focused bank in India, you can’t go wrong with IndusInd Bank.

Read Also- Fuel Credit Cards Benefits, Features

Key Features of IndusInd Bank Pioneer Heritage Credit Card

The IndusInd Bank Pioneer Heritage Credit Card is a top-tier credit card that comes loaded with plenty of benefits and features. Some of the standout features of this credit card include an attractive rewards program, complimentary airport lounge access, and exclusive vouchers and discounts on various lifestyle products and services. The card also comes with a zero-liability protection policy that keeps cardholders from having to take on any liability for unauthorized transactions. Other handy features include a 24/7 customer service hotline, mobile alerts for transaction updates, and an easy-to-use online banking system. All of these features make the IndusInd Bank Pioneer Heritage Credit Card a great choice for anyone looking to get the most out of their credit card experience.

- Get 1 award point for each Rs.100 spent on homegrown spends.

- One ticket to a movie is free when you buy another.

- Each cardholder will receive two complimentary visits to an international lounge each calendar quarter.

- At partner restaurants, receive a discount of up to Rs. 3,000 on the total amount you pay.

- On transactions valued between Rs.400 and Rs.4,000, you can avoid paying a fuel surcharge of one percent.

Click here- Rewards Credit Cards Benefits

Features and Benefits of the IndusInd Bank Pioneer Heritage Credit Card

The IndusInd Bank Pioneer Heritage Credit Card is a great option for those who value convenience, rewards, and exclusive perks. One of the key benefits of the card is its generous rewards program, which allows you to earn reward points on all your purchases that can be redeemed for a range of rewards, including cashback, travel, and merchandise. In addition, the card offers a range of exclusive lifestyle benefits, such as discounts on shopping, dining, and entertainment, as well as priority lounge access at airports.

Another key feature of the card is its contactless payment technology, which allows you to make secure and seamless payments with just a tap of your card. Additionally, the credit card also provides complimentary insurance coverages, such as air accident insurance and lost card liability, giving you added peace of mind. With so many great features and benefits, the IndusInd Bank Pioneer Heritage Credit Card is an excellent choice for those looking for a reliable and rewarding credit card experience.

| Welcome Benefits |

|

| Reward Point Benefits |

|

| Entertainment Benefits |

|

| Golf Benefits | Get 4 free golf games and 4 free golf lessons every month. |

| Travel Benefits |

|

| Concierge Benefits | Access to concierge assistance for hotel, flight, sports, and entertainment reservations round-the-clock. |

| Insurance Benefits |

|

| Dining Benefits | At partner restaurants, receive a discount of up to Rs. 3,000 on the total amount you pay. |

| Fuel Benefits | 1 percent reduction in the fuel surcharge for transactions totaling between Rs. 400 and Rs. 4,000 |

| Club ITC Benefits |

|

Read Also- Cashback Credit Cards Benefits

IndusInd Bank Pioneer Heritage Credit Card Fees and Charges

| Type of Fee | Amount |

| Finance charge | 3.83% per month |

| Add-on card fee | NIL |

| Overlimit charges | 2.5% of overlimit amount, subject to a minimum of Rs.500 |

| Late payment fee |

|

| Cash advance charges | Waived |

| Return cheque fee | Rs.250 |

| Balance enquiry charges on non-IndusInd Bank ATMs | Rs.25 |

| Card replacement | Rs.100 |

| Duplicate statement request | Rs.100 per statement (beyond last 3 months) |

| Railway booking surcharge | As applicable |

| Foreign currency mark-up | 3.5% |

| Cash Payment Fee at IndusInd Bank Branch | Rs.100 |

| Priority Pass Lounge | Up to $27 per person per visit |

Check Here- WB Student Credit Card Scheme 2023

Documents Required

| Identity Proof | Income Proof | Proof of Address |

| Voter ID | IT Returns | Aadhaar Card |

| Driving Licence | Salary Slip | Ration Card |

| Aadhaar Card | Form 16 | Voter ID |

| Passport |

Check Also- How to Get a Credit Card with A CIBIL Score of 700?

How To Apply for IndusInd Bank Pioneer Heritage Credit Card 2023?

If you’re looking for a credit card with excellent benefits, the IndusInd Bank Pioneer Heritage Credit Card might be just what you need. This card offers a range of perks, including cashback on dining and movie tickets, special discounts on travel, and complimentary airport lounge access. In addition to these rewards, the IndusInd Bank Pioneer Heritage Credit Card offers a number of other benefits, such as zero lost card liability and fraud protection, making it a great choice for anyone looking for a reliable and secure credit card.

To apply for this card, simply visit the IndusInd Bank website and fill out the easy online application. If you have any questions or concerns, the bank’s friendly customer service representatives are always available to help you throughout the process. IndusInd offers an extensive rundown of IndusInd Bank Master cards online with various cashbacks offer and energizing prize focuses particularly created for their clients. Fuel, dining, movie tickets, shopping, premiums, and other categories are the most common uses of reward points.

- To begin the application process, click this link.

- Enter basic information like your city, job, monthly income, and contact number. A list of credit cards for which you are eligible will now be displayed to you.

- Check your eligibility for the IndusInd credit card of your choice from the list.

- You can complete the online application if you are eligible.

Conclusion

If you’re looking for a credit card that offers great rewards, benefits, and features, the IndusInd Bank Pioneer Heritage Credit Card is definitely worth considering. With this card, you can earn rewards points for every purchase you make, which can be redeemed for a variety of exciting rewards, including travel, merchandise, and more. In addition to rewards, the card also offers a range of benefits, including airport lounge access, complimentary golf games, and insurance coverage. It also comes with a host of features, such as contactless payment technology and easy bill payment options. IndusInd Bank Pioneer Heritage Credit Card is a great choice for anyone looking for a credit card that offers great value and convenience.

Related Post-

How to apply for HSBC Platinum Credit Card?