How to Apply for LIC Loan Against LIC Policy- Life Insurance Corporation of India (LIC) offers secured personal loans, also known as loans against LIC policy, in addition to insurance plans. By depositing your LIC policy as security or collateral, you can get this kind of loan. Because it is a secured loan, you can get this personal loan to meet your urgent needs at relatively low interest rates.

Life Insurance Corporation (LIC) is India’s largest insurance company. In addition to a variety of insurance products, LIC gives policyholders the option to use their insurance policies as collateral for personal loans. The interest rates on these secured personal loans against LIC policies start as low as 9% per annum. and have a repayment term of up to five years. You can get a loan for up to 90% of the policy’s surrender value to cover things like getting married, paying for college, and other personal expenses. Once you receive the letter, it is important to keep it handy so that you can use it to apply for any future loans against your policy.

How to Apply for LIC Loan Against LIC Policy 2024

The Life Insurance Corporation of India offers a variety of policies that permit policyholders to apply for loans against the sum assured. Customers of LIC can take care of their emergency liquidity needs with the assistance of this unique feature. Policyholders must meet certain requirements and adhere to a standard procedure established by the company in order to obtain a loan from LIC, as will be discussed in the following sections. If you don’t have a good credit score or are having trouble getting a loan from a private or public sector bank, you can get a personal loan with a loan against your LIC policy.

You will need to provide proof of ownership or ownership interest in your policy, as well as some information about the insurance company that issued the policy. The insurance company may also require additional documents or information to evaluate your application and determine whether you qualify for a LIC loan. Once you have provided all the required documentation, the insurance company will evaluate your application and decide whether you are eligible for a LIC loan. If you are approved, it will usually take several days or weeks to process the loan and issue a formal approval letter.

| Name Of Article | How to Apply for LIC Loan Against LIC Policy 2024 |

| LIC Loan Against LIC Policy | Click Here |

| Category | Trending |

| Official Website | Click Also |

About Loan Against LIC policy

Life Insurance Corporation of India (LIC), India’s oldest and largest insurance company, has a large customer base. It provides loans against its insurance policies in addition to offering a variety of insurance plans. LIC, banks, and other NBFCs (non-banking financial corporations) offer the loan.

The policyholder typically pays a premium to the insurance company and receives a cash payment upon the insured’s death. The amount of the payout is typically based on the face value of the policy, with any additional amounts owed to the lender determined by the terms of the contract.

The loan against a life insurance policy can be useful in situations where an individual needs financial support but does not want to make drastic changes to their personal finances. For example, someone who has recently lost a loved one may be able to take out a loan against their life insurance policy without having to worry about how they will pay for funeral expenses or other unexpected costs.

Click Also- Chhattisgarh Postal Circle

Conditions for taking Loan Against LIC Policy

To take a loan against your Life Insurance Policy, you will need to meet certain conditions and requirements. You must be the owner of the policy and have the right to transfer ownership or control of the policy to another party. You must also be able to provide documentation that shows you are in good financial standing, such as a recent bank statement or tax record. Additionally, you must be able to repay the loan based on your ability to do so and not on the condition of your financial situation.

To borrow against an LIC policy, there are some prerequisites.

- Some policies acquire surrender value after a few years; in this case, if the policy is surrendered within this period, the insurer is obligated to pay nothing.

- Loans can be used on policies with at least three premium payments. Loan values can be up to 90% of surrender value or 85% of paid-up policies. As a result, in these situations, the loan cannot be extended until such a time has passed.

- The policy will serve as collateral for these loans. In the case of this kind of loan, interest is typically paid on a half-yearly basis.

- The grace period provided to borrowers is 30 days from the due date; if the borrower fails to settle the loan within 30 days from the due date, lender (including LIC) can foreclose the policy and use the proceeds to settle the loan.

- In the unfortunate event of the borrower’s death, the insurer will settle the claim (with the nominee) after reducing the outstanding loan amount. In the event of the borrower’s death, the insurer will settle the claim (with the nominee) after reducing the outstanding loan

Read Also- How to accept WhatsApp Privacy Policy

Loan Against LIC Policy Interest Rates

| Bank/NBFC/HFC | Interest Rate |

| Kotak Mahindra Bank | 10.75% onwards |

| LIC Housing Finance | 14.80% onwards |

| Axis Bank | 10.25% p.a. onwards |

| Bajaj Finserv | 13% onwards |

Check Also- How to Open PPF Account Online

How to Apply for Loan against LIC policy?

Loan against life insurance policy is a financial product that allows the insured to borrow money against the value of their life insurance policy. It’s usually used by people who want to fund a long-term financial goal, such as paying off debt or buying a home, but don’t have enough cash in their current budget to do so.

To apply for a loan against an insurance policy, you’ll need to submit an application form along with proof of your life insurance payout. The lender will then determine if you’re eligible for the loan and how much you’ll be able to borrow. Depending on your individual situation and the value of your policy, you may be able to borrow up to the amount of your payout or even more.

Loan against life insurance can be a valuable tool for people who want to ensure they have enough financial resources to pursue their long-term goals without needing to take on additional debt. So if you’re looking for ways to manage your finances and accomplish your goals, consider applying for a loan against an insurance policy.

At the moment, you can apply for the same job either in person or online:

Offline Method

In order to use the offline method, you will need to go to a nearby LIC office, complete the loan application forms, provide any necessary KYC documents, and then send those documents along with the original policy document.

Online Method

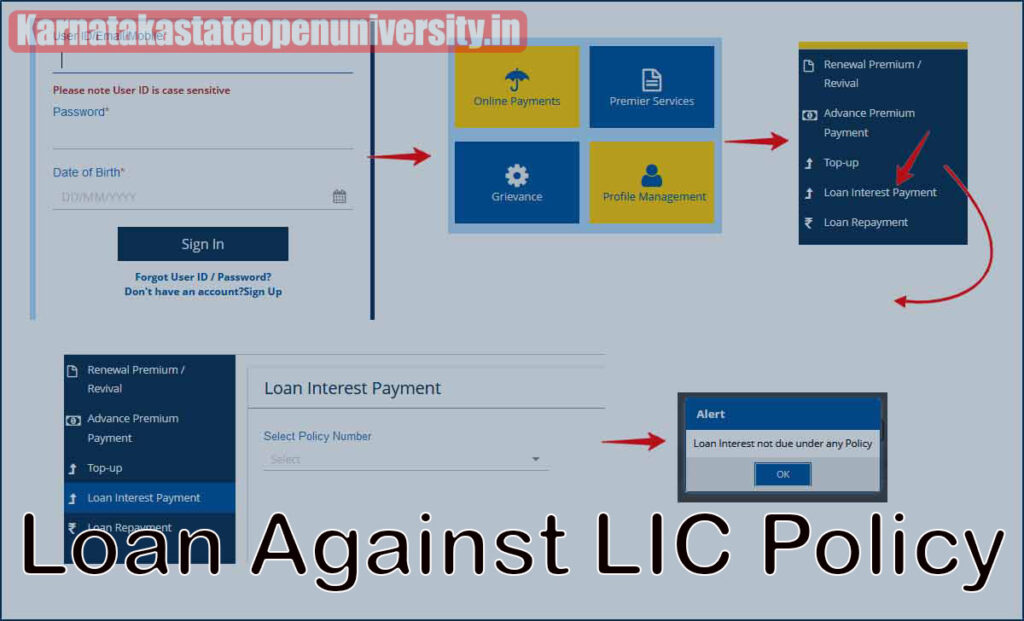

You can check to see if your insurance policy qualifies for a loan secured by the LIC policy by logging into your online account if you have registered for LIC e-Services.

Check Also- How to Apply for PAN Card Online?

Documents Required

In order to submit an application for this secured loan, the following list of essential personal loan documents must be submitted:

- Original policy document, filled-in application form, and photographs in the size of passports Passport, Aadhaar Card, Voter ID Card,

- Proof of Residence: Driving License, Utility Bills (for water or electricity), Aadhaar Card, and Voter ID Card Documents such as bank account statements and salary slips are also required by LIC.

Also Read- LIC Jeevan Labh Plan 2024

Loan Repayment Schedule

A loan against an LIC policy is only available for a minimum of six months. The minimum amount that can be pre-paid is six months, even if the loan has a longer term. At the time of loan approval, the borrower receives the complete repayment schedule, which can be accessed online through the LIC eServices portal. If the policy matures or the borrower dies before the six-month period ends, the policy proceeds will be used to pay off the loan, and interest will only be charged for the amount of time the loan was outstanding.

To repay the loan, you can follow the following procedures:

- You can settle the principal amount with the claim amount at maturity by paying interest in addition to the principal for a few years

- Then repaying the principal when you have extra cash.

Conclusion

If you have a LIC policy, you can use it to take a loan against your policy. This is an option that may be available to you if you are unable to make payments on the policy or if you have financial difficulties. It involves transferring the funds from your policy into a trust account and then applying for a loan against that trust account. The loan against your LIC policy will be secured by the funds in the trust account and will typically have fixed interest and repayment terms.

It is important to understand that this type of loan is not guaranteed to provide financial relief, but rather it is an option that may help you manage your insurance costs or pay off existing debts while still protecting yourself financially. Apply for a loan against your LIC policy carefully, as there are many factors to consider before making such a decision, including your insurance needs and financial situation. If you are unable to make payments on your policy or have financial difficulties, we recommend consulting a lending institution or insurance broker to discuss options that are tailored to your specific needs and circumstances.

Related Post-