Download Form 15G- The Employee Provident Fund is a fund dedicated to employee benefits, with 12% of the employee’s base salary and dating allowance paid into the fund account each month. Corresponding contributions are made by the employer. This fund balance will earn an annual interest rate of 8.10%.

This PF balance can be withdrawn according to the PF Withdrawal Rules. However, according to Section 192A of the Income Tax Act, TDS (withholding tax) is deducted if the amount withdrawn exceeds Rs. 50,000 per fiscal year. So you just have to balance. However, if your income is below your taxable threshold, you can verify that your payment is free of TDS deductions by completing PF Form 15G. Read on for more on this topic.

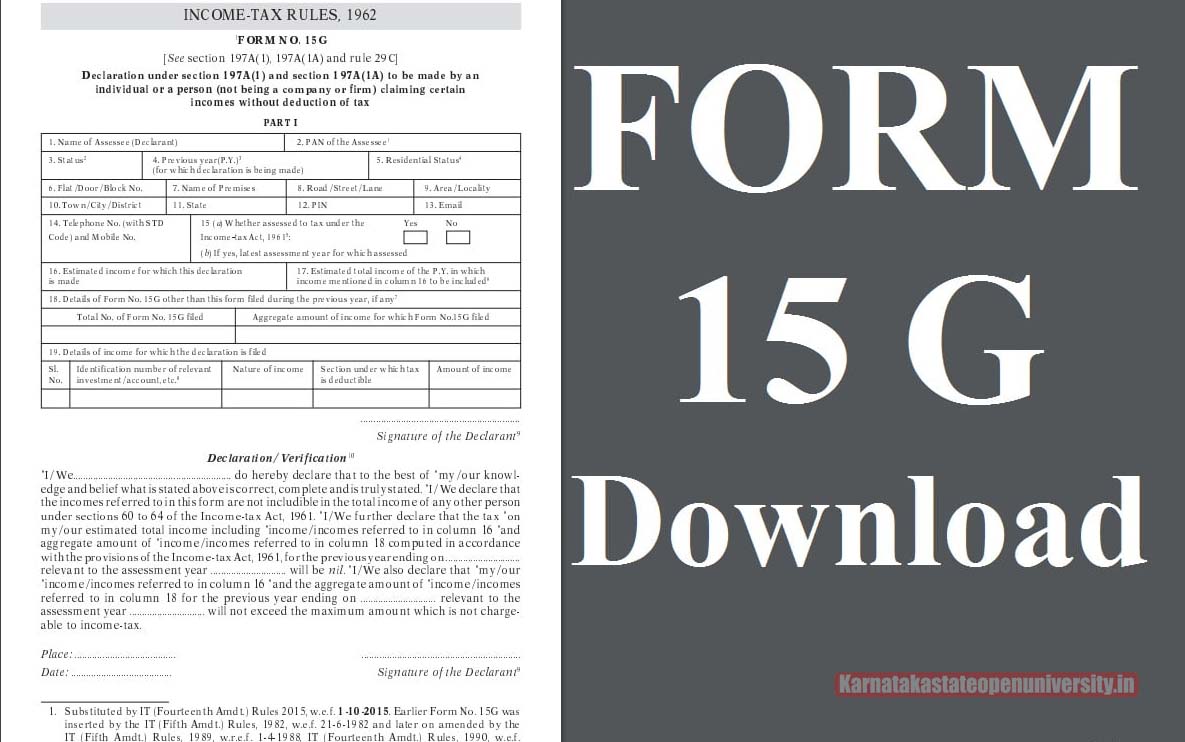

Download Form 15G

This form was created for individuals or individuals (not corporations or corporations) claiming constant income without tax deductions for PF withdrawals. Form 15G is for individuals who do not wish to claim her TDS deduction for certain income. A fixed deposit holder (under age 60) must complete this to prevent her TDS (withholding tax) from being deducted from her interest income for the year.

Income tax law requires a bank to deduct withholding tax (TDS) if he earns more than $10,000 in interest in a fiscal year. Recently, the EPFO Consolidated Portal introduced a way to submit EPF Form 15G to her PF. This allows EPF members to withdraw her PF online. Please use the link below to download a copy of the PDF Form 15G.

Download Form 15G Overview 2024

| Name Of Article | Download Form 15G |

| Year | 2024 |

| Category | How to guides |

| Official Website | Click here |

Key Features of Form 15G

The Form 15G, commonly referred to as the Foreign Bank Account Report, is a form that foreign financial institutions are required to file with the United States Department of the Treasury. The form is used to report any assets held by the foreign bank in U.S. dollars or any income earned by the bank in the United S tates. The report includes information about each account, such as its name, address, and type. It also provides detailed information about the amount, frequency, and purpose of transactions made into and out of each account. The form is also useful because it allows the Department of Treasury to identify potential money laundering activities within a foreign bank’s operations.

Key features of the Form 15G include:

- Form 15G is a self-assessment to request no TDS withholding on certain income because the tax beneficiary’s annual income is below the exemption limit.

- The rules for this particular self-assessment form are set forth in Section 197A of the Income Tax Act of 1961.

- Significant changes were made to the Form 15G structure in 2015 to reduce the burden and cost of both tax and withholding compliance.

- The current format of Form 15G and Form 15H (an advanced variant of Form 15G) introduced by the CBDT (Central Board of Direct Taxes).

- Form 15G can be filed by anyone under the age of 60. Everyone over the age of 60 falls into the senior category.

- Form 15H is similar in many ways to Form 15G, but is only for use by seniors.

- This declaration must be submitted for existing systems in the first quarter of the fiscal year to claim benefits. However, for new investments, Form 15G may be filed before the first accrual of interest.

Check Also:- How to Remove Scuff Marks From Car

Eligibility Criteria for Submitting Form 15G

To submit Form 15G, you must meet the following eligibility criteria:

- You are an individual or an individual (other than a legal entity or company).

- Must be a resident Indian for the relevant fiscal year.

- Age he must not exceed 60 years.

- Zero tax liability calculated based on total taxable income for the fiscal year.

- Total interest income for the fiscal year is below the base exemption limit.

Instructions to Fill out Form 15G

This form is used to report any taxable payments made to foreign governments, organizations, or individuals. Payments must be made in U.S. dollars and must be made either by check, wire transfer, or other means of payment that can be traced to a specific account. If a payment is not reported on Form 15G, the payer may be subject to penalties and/or income taxes on the unreported payments. The form should be filled out as follows:

Form 15G has two sections. The first part is for those who don’t want to claim her TDS deduction for certain income. The main details you will need to complete in the first part of Form 15G are:

- Your name as it appears on your PAN card.

- Permanent account number. A valid PAN card is required to submit Form 15G. If you do not provide valid PAN data, your claim will be treated as invalid.

- Form 15G can be filed by individuals, but not by companies or corporations. Select the previous year as the fiscal year to claim the non-deductible from TDS.

- Please refer to your status as a resident as NRIs are not permitted to submit Form 15G.

- Enter the communication address correctly along with the PIN.

The second part of Form 15G must be completed by the withholding agent. H. Any person who pays withheld taxes to the government on behalf of the tax beneficiary.

Check Also:- How to Clean Slot Car Track Rails

What if I Forget to Submit Form 15G?

It is important to take action if you have a tax debt and are unsure of how to submit Form 15G. You should contact a qualified tax attorney as soon as possible in order to understand your options and how best to pay your taxes. A competent attorney can assist you with navigating the complicated legal system and filing the correct form with the IRS.

If you forgot to submit your Form 15G on time and your TDS has already been deducted, you can:

Step 1:Fileyour income tax return to claim your TDS refund.

Once the TDS is deducted by bank or other deductions, the amount must be submitted to the income tax authorities and no refunds are possible. The only solution is to file an ITR to get your income tax refund. After verification, the Income Tax Department will process your claim and credit any excess tax deducted for that fiscal year.

Step 2: File Form 15G now to avoid further deductions for the current fiscal year.

Banks typically deduct TDS at the end of each quarter when calculating interest applicable to term deposits. We recommend that you file Form 15G as soon as possible to avoid additional deductions for the current tax year.

When can Form 15G be Submitted?

Form 15G can be submitted to the IRS as early as 60 days after the end of any tax year in which you believe that you may owe additional taxes and wish to request a final determination. The form must be submitted to the IRS’s Taxpayer Advocate Service (TAS) by mail, fax, or email. You can find information about how to file Form 15G on the TAS website.

The IRS uses Form 15G to determine if the taxpayer is eligible for a refund or owes additional taxes. It will review the taxpayer’s records and correspondence and make a decision about the case. If the IRS determines that additional taxes are owed, it will send the taxpayer a notice of deficiency or a notice of tax due.

A Form 15G return can be filed to reduce the TDS burden if:

TDS on Interest Income from Bank Deposits

Banks are said to deduct TDS if interest on fixed deposits or periodic interest exceeds Rs. 10,000 in one year (from 2019-20, this threshold has been increased to INR 40,000 per year). The important thing to note here is that banks deduct TDS based on preliminary interest, not actual interest payments. Therefore, even if the term of your term deposit exceeds one year, you must file Form 15G to avoid the TDS deduction.

Click Here- How to Remove Melted Cravon from Car seat

TDS on Employee’s Provident Fund Withdrawal

If the employee’s provident fund is withdrawn before completing five years of service with the current organization, TDS will be applied to the earnings. You can still file Form 15G without any TDS deductions, even if your total taxable income, including any outstanding retirement fund payments, is zero.

TDS on Interest from Post Office Deposits

Post offices that offer deposit services will also accept returns of Form 15G for Postal Deposits and National Savings Plans, provided that all requirements for submitting Form 15G are met.

TDS on Income from Corporate Bonds and Debentures

Any debenture income exceeding Rs. 5000 in a financial year is subject to withholding tax. In such cases, if you are eligible to file Form 15G, you may do so and ask the bond issuer not to withdraw his TDS.

TDS on Proceeds from Life Insurance Policy

Pursuant to the provisions of Section 194DA of the Income Tax Act, 1961, if the maturity income of a life insurance policy is Rs.1 million, such income will be withheld for tax purposes. However, if all the conditions set out in the Form 15G return are met, the taxpayer may submit the Form 15G to the life insurance company to prevent TDS withholding.

TDS on Rental income

If the rental income for the fiscal year is Rs 8 million, such income is subject to withholding tax. However, if your taxable income is less than the basic deduction limit, you can file Form 15G without the TDS deduction.

Submission of Form 15G

The Central Board of Direct Taxes (CBDT) has digitized the Form 15G and Form 15H filing process. Below is the process of filing Form 15G online at a major bank. The submission of Form 15G is required to report certain transactions and other events that occur outside the United States. These transactions and events may be reported by a foreign financial institution (FFI) or a U.S. person (USP). The form is used to report the following activities:

- Taxpayers must complete and submit Form 15G online. According to the Central Direct Tax Commission (CBDT), the withholding agent must assign her UIN (Unique Identification Number) to each taxpayer’s self-assessment.

- The withholding agent must submit all self-assessment details along with a unique identification number (UIN) to the Income Tax Department via her quarterly TDS return.

Please note that self-declaration on Form 15G is only valid for each fiscal year. A new declaration must be filed for the next fiscal year. However, current government rules and regulations require the withholding agent to retain Form 15G for her seven years.

Check Also:- How to Replace Car Keys 2024

How to Fill Form 15G Online?

The IRS has many online resources to help you get your taxes done. One of the most useful is the Form 15G tax form. This form is used to report the income earned from a foreign source and is required for individuals who are living or working outside of the United States. To fill out this form, all you need to do is provide the required information and submit it online through the IRS website. If you have any questions about how to fill out this form, feel free to reach out to us at any time. We’re here to help!

Most Indian banks now offer the facility to complete and submit Form 15G online. You must be logged into Internet Banking to use this feature. Method is as follows.

- Log in to your bank’s Internet Banking with the appropriate User ID and Password.

- Click the Online Term Deposits tab to go to the page where you can view your term deposit details.

- On the same page, you should have the option to generate Form 15G and Form 15H. Click the available link to open the option to fill out the form.

- Once the form has been opened online in a fillable format, enter your details and information carefully.

- Please enter the bank details where your FD/RD is registered. If you don’t have these details handy, you can use our bank branch locator tool to easily find the details you need.

- Please fill in all other details related to your investment correctly and submit.

IT Act Sections and Rates for Tax Deducted at Source

Filling out a T2125 online is very easy, and there are several different methods that you can use. Some popular options include using a computer, smartphone, or tablet device, as well as completing the form using a web browser. The steps for completing a T2125 online will depend on your situation and individual needs, but some general steps may include providing basic personal information such as your name, address, and phone number, as well as any other relevant information that needs to be provided. After submitting your T2125 online you will receive confirmation via email or message stating that your form has been received and processed successfully.

Below is a general TDS section for quick reference.

| Investment Type | Sections of Income Tax Act | Threshold limit | TDS (with Valid PAN) | TDS without PAN |

| Interest on Bank Deposits | 194A | 10,000 | 10% | 20.00% |

| EPF Proceeds- Premature Withdrawal | 192A | 30,000 | 10% | 34.61% |

| Interest on securities | 193 | – | 10% | 20.00% |

| Dividend income | 194 | 2,500 | 10% | 20.00% |

| Interest other than interest on securities | 194A | 5,000 | 10% | 20.00% |

Also Check- Delete Gmail Account 2024

Penalty for Submitting False Declaration using Form 15G

The penalty for submitting a false declaration to the Philippines can be severe, but it is important to remember that failing to report income or assets can have serious consequences. In some cases, individuals may face criminal prosecution and may be required to pay significant amounts in fines and legal fees. So it is important for all individuals to report their income and assets truthfully so that they can avoid any disputes with tax authorities.

False filing on Form 15G solely to avoid TDS can result in fines and imprisonment under Section 277 of the Income Tax Act of 1961. Below are the details of the penalties under Section 277 of the IT Act of 1961.

- Imprisonment for a period of 6 months to 7 years if a false declaration is made to avoid tax exceeding Rs. 10,000 rupees.

- In all other cases, from 3 months to 3 years he imprisonment.

Therefore, instead of making any false statements, you should file Form 15G only if you are permitted to do so.

Conclusion

Form 15G, also known as a Statement of beneficial ownership, is a document that provides financial discloser information about who owns or controls a company or organization. The form is typically used by investors and other parties interested in conducting business with the organization. Form 15G can be used to determine the true owners of an organization and their relationship to the business. This helps ensure that those in control of an organization are acting in the best interests of all parties involved.

Related Post:-